Introduction to Cryptohopper’s Trading bot

Automated trading can be both powerful and complex. This article serves as a comprehensive guide to Cryptohopper's Trading Bot, offering insights and resources to help you navigate this innovative trading platform effectively.

Topics Covered:

- How does the Trading bot work.

- Ensuring correct bot setup.

- Trading automatically.

- Understanding subscriptions.

- Monitoring your trading bot on the go.

1. How does the Trading bot work

Cryptohopper's Trading Bot comprises four essential configuration tabs that work in tandem to automate your trading strategy. Understanding these tabs is crucial for configuring your bot with confidence:

Baseconfig:

This serves as the central command center for your trading bot. Here, you can connect to your preferred exchange, configure buy and sell settings, and specify the conditions under which you want to initiate trades, such as strategy-based or signal-based triggers.

Config Pools:

Config Pools allow you to override your Baseconfig settings for specific currencies or groups of currencies. For instance, when dealing with highly volatile assets, you can apply different strategies and buy/sell settings to optimize your trading approach.

Signals:

The Signals tab enables you to configure buy and sell settings based on trading signals sourced from a Marketplace Seller. It's important to note that once a position is opened based on a signaler's settings, these settings won't automatically update with changes in your Baseconfig or Config Pools.

Triggers:

Triggers are customizable event-based actions that can automate specific responses. For instance, you can set up your bot to halt new orders if a particular cryptocurrency's price drops by 5%, thereby avoiding further purchases during a downward trend.

We highly recommend using a Paper Trading bot initially to become familiar with these settings. Additionally, our Backtester tool allows you to assess how your configurations would have performed historically, providing valuable insights into potential outcomes.

2. Ensuring correct bot setup

At Cryptohopper, we prioritize helping users verify that their trading bot is correctly configured. The Troubleshooter, accessible in the top menu of your Dashboard, is a recommended tool to periodically check your setup, especially when you've just initialized your bot. For in-depth guidance on this feature, refer to our dedicated article. If you still have doubts or need assistance, our support team is readily available via the chat button in the lower right corner of your browser.

3. Trading automatically

Getting started with Cryptohopper offers several ways to trade automatically and access valuable tools to enhance your trading journey:

Manual Buying with Automated Selling:

If you prefer to decide when to enter trades manually, you can use the Advanced Dashboard. Customize options like Take Profit, Trailing Stop-Loss, Stop-Loss, or Dollar-Cost Averaging (DCA) to eliminate emotional trading. Positions without specific sell settings will adhere to your bot's configurations.

Strategy with Technical Indicators:

Utilize the Strategy Designer to create your own trading strategies based on technical indicators. You can also explore the Marketplace for pre-designed strategies that can be backtested before implementation.

Trade Based on Trading Signals:

For those uncertain about trade timings, consider subscribing to trading signals from signalers. Download recommended bot templates and add the suggested currencies to your "Coins and Amounts" in your Config to get started.

AI Strategy Designer:

Exclusive to pro traders and Hero subscribers, the AI Strategy Designer allows you to select multiple strategies, signalers, or TradingView Alerts, letting the AI choose the best strategy based on market conditions.

TradingView Alerts:

If you use TradingView, create alerts that automatically trigger Cryptohopper to open or close positions on your behalf.

4. Understanding subscriptions

A single Explore, Adventurer, or Hero subscription permits you to create one live bot on an exchange with real funds and one Paper Trading bot with simulated funds. In other words, every subscription includes the capability to run a Paper Trading bot alongside your live bot.

Watch our video guide on how to assign subscriptions and refer to our pricing page for a detailed breakdown of the differences between Explorer, Adventurer, and Hero subscriptions. Notably, there's no need to assign a subscription to a Paper Trading bot, as our system automatically tracks the number of Paper Trading bots available. An advantage of Paper Trading is the ability to trade up to 75 currencies within a single bot.

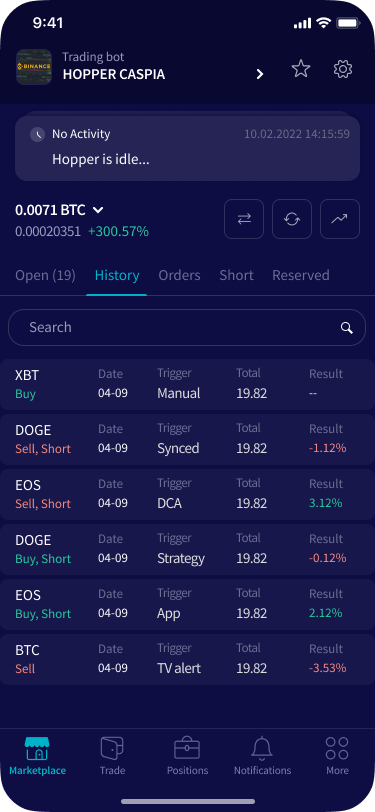

5. Monitoring your bot on the go

The cryptocurrency market operates 24/7, making it essential to stay informed and manage your bot efficiently. We recommend using our iOS or Android apps for mobile access. Refer to the dedicated section in our Documentation to find answers to your app-related queries.

Cryptohopper is committed to simplifying automated trading while providing a robust set of tools and resources to empower traders of all levels. With this guide, you're well-equipped to embark on your trading journey with confidence. If you ever need assistance or have further questions, don't hesitate to reach out to our dedicated support team.