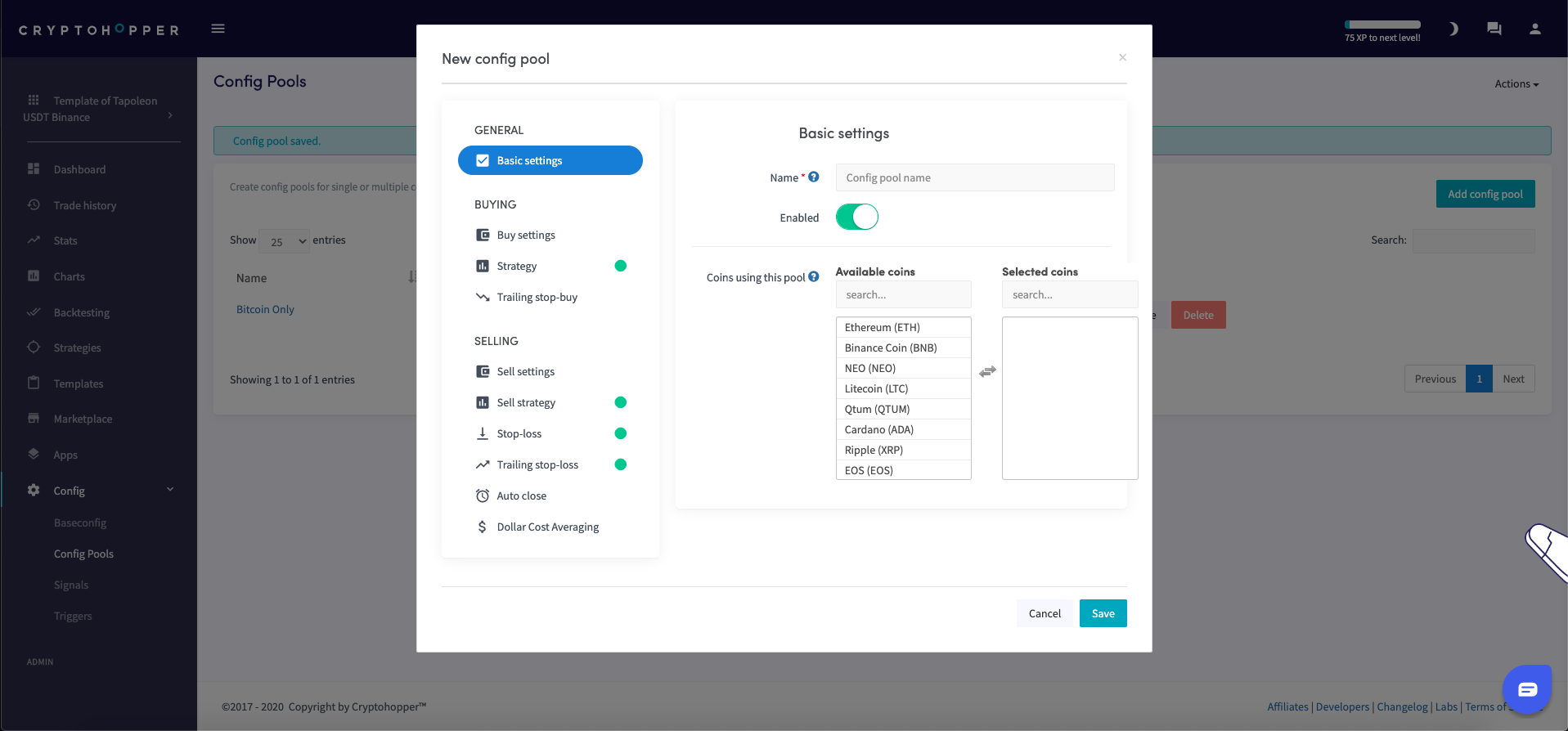

What are the settings in the Config Pool

This tutorial explains the different settings in the Config Pool.

Basic settings

Name

Name the Config Pool.

Enable

When setting up a Config Pool the switch is toggled at enabled. Only switch the toggle to disable the Config Pool.

Currencies using this pool

Select the coins for this Config Pool.

Buy settings

Order type

Select what order type your bot should use for buying. Market orders will be filled immediately, but could result in lower profits or bigger losses. Especially when there’s low volume or high volatility in the market. Limit orders are orders for a specific price that take longer to fill.

Max open time buy

Fill in the number of minutes a buy order should be open before the order is canceled. A small portion of your funds are reserved when an order is placed, so you want to cancel orders to have funds free to make other trades.

Cooldown

Switch the toggle so your bot will not try to buy a coin within your chosen cooldown period after a buy or sell. This prevents your bot from buying too much of the same currency when it receives multiple buy signals simultaneously.

Cooldown when

Select if you want a cooldown period after buys, sells or both.

Cooldown period

Fill in the number of minutes your bot is in the cooldown period for the currencies selected.

Strategy

Strategy

Switch the toggle if you want to use a Strategy. If you have Strategy enabled in your Baseconfig these settings will be copied here. You can tweak the Strategy for the Config Pools.

Trailing Stop- Buy

Trailing Stop-Buy

Switch the toggle to enable Trailing Stop-Buy. If you have Trailing Stop-Buy enabled in your Baseconfig these settings will be copied here. You can tweak the Trailing Stop-Buy for the Config Pools.

Trailing Stop-Buy percentage

Fill in the percentage that the price should rise before your Trailing Stop-Buy is triggered.

Sell settings

Take profit at

Fill in the percentage profit you want to make on a position before selling. When a position goes above this percentage, your bot will place a sell order. The settings you filled in with the Baseconfig are copied here. You can tweak it for the Config Pools.

Order type

Select what order type your bot should use for selling. Market orders will be filled immediately, but could result in lower profits or bigger losses. Especially when there’s low volume or high volatility in the market. Limit orders are orders for a specific price that take longer to fill. The order type you selected with the Baseconfig is copied here. You can change it for the Config Pools.

Max open time sell

Fill in the number of minutes a sell order should be open before the order is canceled. Setting a short sell open time your bot can try again quickly. It can also result in your orders only being partially filled. The minutes you filled in with the Baseconfig is copied here. You can tweak it for the Config Pools.

Sell strategy

Sell based on strategy

Switch the toggle if you want to use a strategy to sell. Your bot will sell your positions when your TA strategy signals to sell. Important: with this setting, your positions could be sold at a loss. If you have Sell Strategy enabled in your Baseconfig these settings will be copied here. You can change it for the Config Pools.

Only sell in profit

When enabled and your strategy or TradingView Alert signals a sell, only positions in profit will be sold. In this case, other sell settings will be overruled.

Sell in profit percentage

Only sell with strategy if profit is higher than this percentage.

Stop-Loss

Enable

Switch the toggle so your bot will use a Stop-Loss. If you have Stop-Loss enabled in your Baseconfig these settings will be copied here. You can change and tweak it for the Config Pools.

Stop-Los percentage

Fill in the percentage your position needs to go down before your Stop-Loss is fired. Enter a positive number. For example, if you want to sell your positions when the price drops 2,5%, fill in 2,5%.

Trailing Stop-Loss

Switch the toggle so your bot will use Trailing Stop-Loss. If you have Trailing Stop-Loss enabled in your Baseconfig these settings will be copied here. You can tweak and change it for the Config Pools.

Trailing Stop-Loss percentage

Fill in the percentage you want the coin to drop. When this percentage is met, your bot will try to sell the position.

Arm Trailing Stop-Loss

Fill in the percentage of profit your position needs to reach before selling. You want to cover the fees you’re paying for the trade. For example, you fill in 1%. Your Trailing Stop-Loss will be armed when the position hits 1% profit. The bot will sell the position once the price drops with the Trailing Stop-Loss percentage.

Use Trailing Stop-Loss only

Switch the toggle so your bot will only use Trailing Stop-Loss to sell a position. When enabled, the bot will not sell your position when your Take profit, Sell based on strategy, or Short based on strategy signals a sell.

Reset Stop-Loss after failed orders

Switch the toggle to reset this setting after a canceled order. Orders can be canceled when they’re not filled or are open longer than configured.

Only sell with profit

Switch the toggle so your bot will check if the position is sold with a profit when the Trailing Stop-Loss is triggered. If Trailing Stop-Loss would sell a position with a loss, then the sell order will not be placed.

Auto close

Enable

Switch the toggle if you want to sell positions after a given time. This is often used by merchants and miners. They want to synchronize positions and automatically exchange them for another (stable) currency. Warning, when enabled all your positions will be sold after X time. Even if they’re at a loss. If you have Auto Close enabled in your Baseconfig these settings will be copied here. You can tweak and change it for the Config Pools.

Close position after X time open

Fill in the time before your bot starts to sell all your positions.

Dollar Cost Averaging

Dollar Cost Averaging

Switch the toggle so your bot will use Dollar Cost Averaging. If you have Dollar Cost Averaging enabled in your Baseconfig, these settings will be copied here. You can tweak and change it for the Config Pools.

Order type

Select what order type your bot should use for buying. Market orders will be filled immediately, but could result in lower profits or bigger losses. Especially when there’s low volume or high volatility in the market. Limit orders are orders for a specific price that usually take longer to get filled.

DCA after X time open

Select the timeframe after you want to create a DCA order for your position. This is brilliant if you're a beginner and want to accumulate Bitcoin (or another currency) over a longer period.

DCA max retries

Fill in the maximum of DCA orders that your bot can create for a specific currency. The count is reset after every successful sell of a DCA order. Important: don’t set this number too high. It could result in even higher losses (in the case you're using it as a tool against loss-making positions).

DCA set percentage trigger

Fill in the percentage the price must fall before your bot should place a new DCA order. Enter a positive number. You can use this as an alternative for Shorting or a Stop-Loss. Using DCA can be expensive as a loss-making position won’t always become positive again. Important: When a new position is created/merged after your DCA order, your position needs to go down with the configured DCA percentage again before it triggers again. It can happen that your DCA successfully finishes its action later than configured, due to a limit order that isn't filled. Consider using market orders.

DCA buy immediately

Switch the toggle to trigger the buy immediately. It will be triggered when the Percentage loss get hit. Important: the bot will buy without taking into account your Strategy and can buy at an unfavorable time.

DCA Order Size

Select how big the orders need to be. The bigger, the more loss you will have when the price drops even further. There are 3 options:

- Double down. This will open a DCA order with the same amount as you have in all open positions for a specific currency.

- Triple down. This will open a DCA order twice as big as all your current open positions of a particular currency.

- Customer percentage. Choose your percentage.