What are the Sell settings in the Baseconfig

This tutorial explains the Sell settings in the Baseconfig.

For more information on the General settings in the Baseconfig, click here.

For more information on the Buying settings in the Baseconfig, click here.

How sell settings work

With the Sell based on Strategy, Take Profit, Trailing Stop-Loss, and Auto Close, it matters which one is triggered first. They can be used simultaneously, and the setting that is met first will sell the position. As an example, it is possible to use the following settings:

Example:

- Take Profit: 10%

- TSL: 1%

- AutoClose: 7 days

When you enable "Sell based on strategy" in the Baseconfig, it results in a sell order when your Strategy's requirements have been met before the other sell features are triggered. This feature only checks your Strategy settings. Selling based on Auto Close could still trigger a sell when the position has not been sold by one of your other sell settings within X period. When “Sell based on Strategy” is enabled, your positions might get sold with a loss.

Stop-Loss will only sell positions when they are in a loss and can be used to prevent losing more on a trade. The last thing that could trigger a sell is your Signaler. When subscribed to a Signaler, it is possible to select "Sell signals" and "Signal configuration" in the Signal config. If you see different trading results than configured in the base config, these two settings could be the reason as you can receive sell signals from the Signaler.

Sell Settings

Take Profit At

Fill in the percentage profit you want to make on a position before selling. When a currency goes above this percentage, your bot will place a sell order.

Order Type

Select what order type your bot should use for selling. Market orders will be filled immediately, but could result in lower profits or bigger losses. Especially when there’s low volume or high volatility in the market. Limit orders are orders for a specific price that take longer to fill.

Max Open Time Sell

Fill in the number of minutes a sell order should be open before the order is canceled. Setting a short sell open time your bot can try again quickly. It can also result in your orders only being partially filled.

Sell Strategy

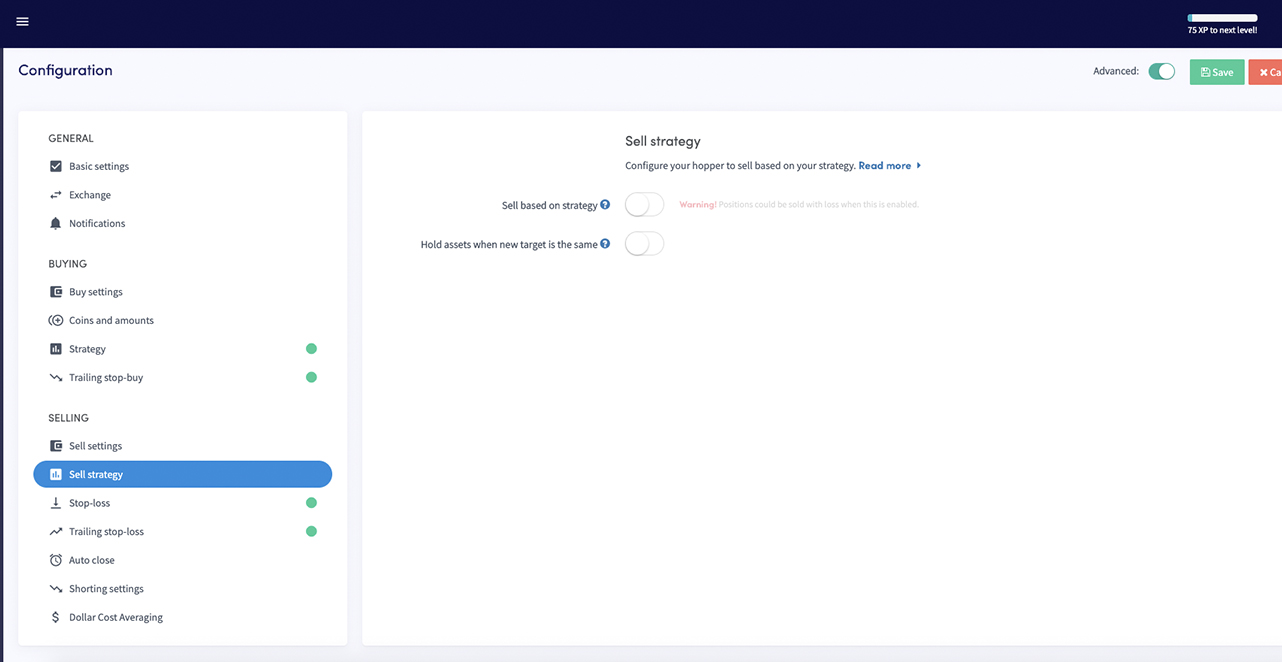

Sell based on strategy

Switch the toggle if you want to use a strategy to sell. Your bot will sell your positions when your TA strategy signals to sell. Important: with this setting, your positions could be sold at a loss.

Only sell in profit

When enabled and your strategy or TradingView Alert signals a sell, only positions in profit will be sold. In this case, other sell settings will be overruled.

Sell in profit percentage

Only sell with strategy if profit is higher than this percentage.

Hold assets when new target is the same

For example, your bot is trying to sell a currency. Your TA strategy indicates that your bot should buy the same currency. If the toggle is switched your bot will not sell the currency, even if it reaches your Take Profit percentage or Trailing Stop-Loss.

Stop-Loss

Enable

Switch the toggle so your bot will use a Stop-Loss.

Stop-Los percentage

Fill in the percentage your position needs to go down before your Stop-Loss is fired. Enter a positive number. For example, if you want to sell your currency when the price drops 2,5% fill in 2,5%. Sometimes it can look like your Stop-Loss didn’t trigger. Check if the Stop-Loss percentage is filled and that there’re no Config Pools active. A Config Pool will override your Baseconfig.

Trailing Stop-Loss

Enable

Switch the toggle so your bot will use Trailing Stop-Loss.

Trailing Stop-Loss percentage

Fill in the percentage you want the currency to drop. When this percentage is met your bot will try to sell the currency.

Arm Trailing Stop-Loss

Fill in the percentage of profit your currency needs to reach before selling. You want to cover the fees you’re paying for the trade. For example, you fill in 1%. Your Trailing Stop-Loss will be armed when the position hits 1% profit. The bot will sell the currency when it drops the Trailing Stop-Loss percentage.

Use Trailing Stop-Loss only

Switch the toggle so your bot will only use Trailing Stop-Loss to sell a position. When enabled, this setting will disable the Take Profit and only use the trailing stop-loss to sell a position.

Reset Stop-Loss after failed orders

Switch the toggle to reset this setting after a canceled order. Orders can be canceled when they’re not filled or are open longer than configured.

Only sell with profit

Switch the toggle so your bot will check if the positions is sold with a profit when the Trailing Stop-Loss is triggered. If a Trailing Stop-Loss would sell a position with a loss, then the sell order will not be placed.

Troubleshooting the TSL

When using the TSL, make sure to set either a high Take Profit, or enable "use Trailing Stop-Loss only". The bot will always sell with whichever setting allows it to sell first.

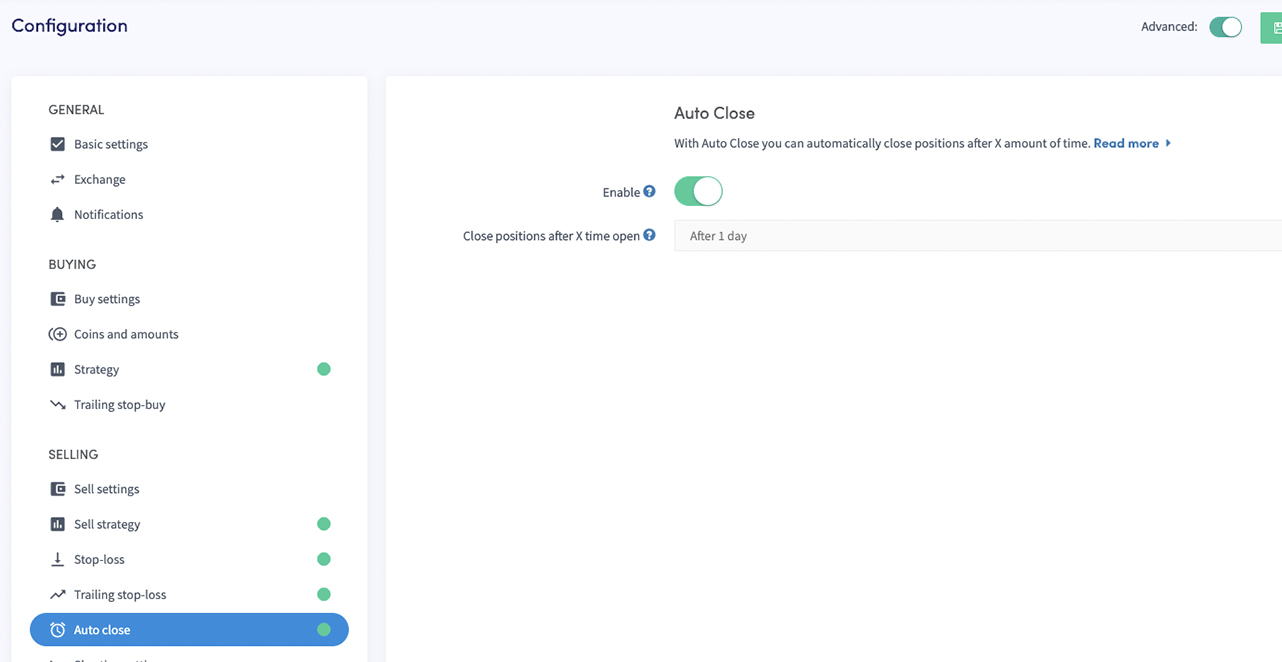

Auto-Close

Enable

Switch the toggle if you want to sell positions after a given time. This is often used by merchants and miners. They want to synchronize positions and automatically exchange them for another (stable) currency. Warning, when enabled all your positions will be sold after X time. Even if they’re at a loss.

Close position after X time open

Fill in the time before your bot starts to sell all your positions.

Shorting

A way to make up for a loss-making position is our Short and Trailing Stop-Short feature. It's an exciting feature for traders that are looking for an alternative for their traditional stop-loss.

Shorting is the practice of making a profit while the price of an asset goes down. Our way of shorting is a little bit different than "traditional" shorting. Our shorting is more like a buyback function. When you expect a position to make a more significant loss, you initiate a Short, and your bot will sell the position. When you think the price has reached its bottom, you consolidate your short and directly buy back the position.

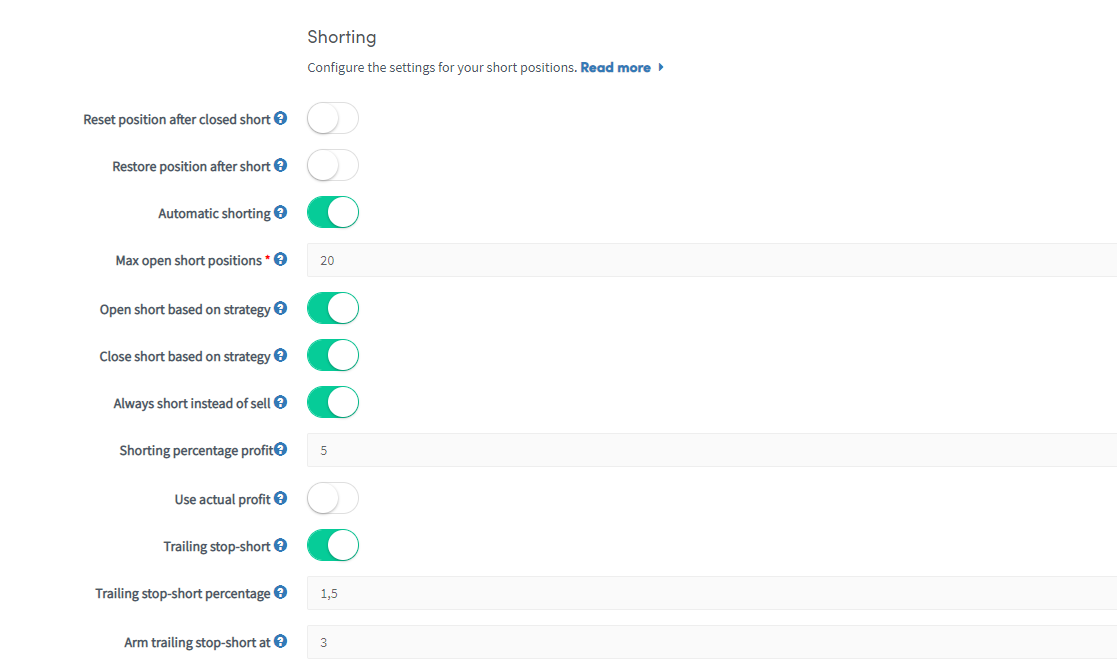

Reset position after closed short

Switch the toggle so the profit percentage will be reset to 0% after the short is closed and the position is bought back.

Restore position after short

Switch the toggle so the original settings of the open position are restored when a short is closed and the position is opened again. For example, the Stop-Loss and the Trailing Stop-Loss.

Automatic Shorting

Switch the toggle so your bot will open short positions automatically. This comes in handy when you want to replace the Stop-Loss with Shorting.

Max open short positions

Fill in the number of maximum open short positions your bot can have. The more open short positions, the longer it will take for your bot to check these positions.

Open short based on strategy

Switch the toggle so Short positions are opened when your Strategy signals a sell. This will override the “sell with strategy” setting. Configure your strategy in the Strategy section in the buying part of the Baseconfig.

Close short based on strategy

Switch the toggle so Short positions will be closed when your Strategy signals a buy. Configure your strategy in the "Strategy" section in the buying part of the Baseconfig.

Always short instead of sell

Switch the toggle so a Short position will be opened when an open position gets sold. This happens with Take profit, Autoclose, Stop-Loss, or Trailing Stop-Loss. This can be an ideal Strategy to prevent losses while making a profit sooner when you've repurchased.

Shorting percentage profit

Fill in the percentage of profit you want to make on each short. When a short position is over this percentage, the short will be closed. Important: you don't make an actual profit with our Shorting, because it's a buy-back tool. The Percentage Profit refers to the losses you've prevented. For example, if the price drops 10% when you've initiated your short, your short will show a 10% Percentage Profit.

Use actual profit

Switch the toggle so the actual profit calculation is used for percentage profit calculation and for the trailing stop-short. This means that your Short will calculate the Percentage Profit compared to the buying price, instead of how much you've saved by Shorting.

Trailing Stop-Short

Switch the toggle so you can use Trailing Stop-Short.

Trailing Stop-Short percentage

Determine the trailing stop-short percentage, for example, 1.5 (%). If the currency goes up 1.5% or more from the moment the trailing stop-short was armed, then it will open a new position.

Arm trailing stop-short at

Fill in the percentage the price of a currency needs to go down before the position is armed. For example, your percentage is 1,5% and the arm is 3%. If the currency goes down more than 3% the bot starts trailing the currency. When the price goes up again by 1,5% your bot will open a position.

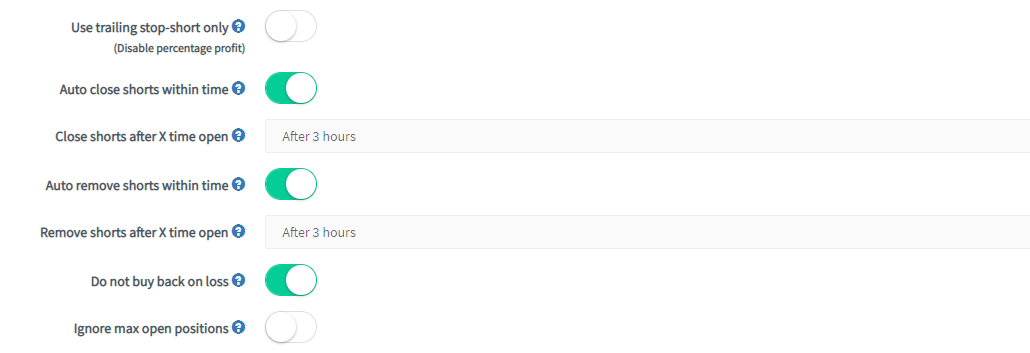

Use Trailing Stop-Short only

Switch the toggle so the bot will only use the Trailing Stop-Short to close a short position. The Take Profit will be disabled.

Auto close Shorts within time

Switch the toggle so your bot will close the Short position after X time.

Close Shorts after X time open

Select the time. This will override the “sell with strategy” setting.

Auto remove Shorts within time

Switch the toggle so your bot will remove the Short position after X time.

Remove Shorts after X time open

Select the time.

Do not buy back on loss

Switch the toggle so your Short positions will be removed instead of repurchased when the signal comes in to close the position, and the short position has not made any profit. You've sold your position back for your quote currency. So with a stable quote currency, this shouldn't give any risks.

Ignore max open positions

Switch the toggle so your bot will ignore the max open positions number when a Short is closed and bought back. Important: this does not allow for opening more short positions through automatic shorting. It’s only about closing the already shorted positions. Keep in mind that shorting won't buy new positions when buying is disabled on your dashboard.

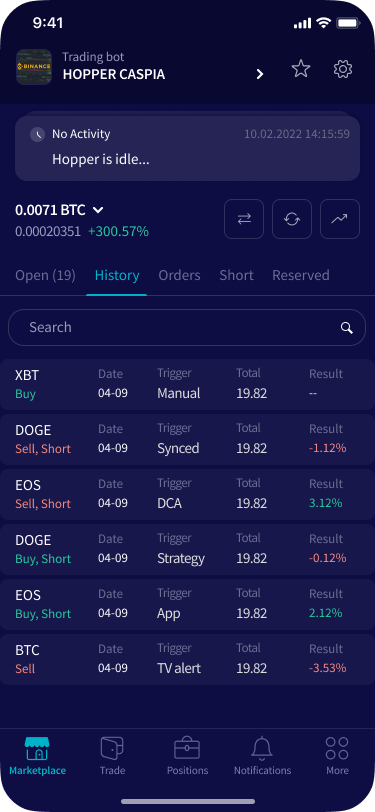

Examples of short trades

Now you should have an idea of what all our shorting features can do, but having some trading examples will make it easier to understand how the mechanisms work. The following shorting configuration is used for shorting trades on Bitvavo.

The first thing that is enabled is "Automated shorting", meaning that when the shorting settings' requirements have been met, a shorting position will be opened in Cryptohopper. This is called an open short position and is only visible in Cryptohopper's Dashboard, not on the exchange. The next setting is "Max open short positions", and it is set at 20 positions. Keep in mind that when funds are reserved for your short positions, these funds are not available to open regular trades. If you configure a high number for this setting, it could result in no new regular positions being opened due to the reserved funds. In the long term, this could stop your bot from trading.

"Open short based on strategy" has also been configured. When your strategy signals a sell, a short position will be created on Cryptohopper, and funds will be reserved. "Close short based on strategy" means that when your strategy signals a buy, an actual order will be placed on the exchange with the previously reserved funds. This is called "closing a short".

"Always short instead of sell" refers to all selling features. When enabled, short positions will be opened when an open position gets sold with profit, autoclose, stop-loss, strategy, or trailing stop-loss. "Shorting percentage profit" is the profit percentage needed before a short position will be closed, meaning that you will buy back the same amount of the currencies for 5% less. Next to the "Shorting percentage profit", you can also use "Trailing stop-short". Trailing stop-short will trail the profit percentage downwards. When the short positions have reached the "Arm trailing stop-short at" percentage, it will close the positions when it has gone up more than 1.5% since its lowest point. In this example, it means that 2 settings can close the short, either when the price goes down by 5% or when the short position's price has gone up more than 1.5%, since the "Arm percentage at" of 3% has been reached. The advantage of using Trailing stop-short is that you will buy back the currency after it has reached its lowest point, and that won't be taken into account when using "always short instead of sell".

If you don't want to reserve funds for too long but want to keep trading a specific currencies, you could use "auto close short within X time". To ensure you will always have funds available to open new regular trades, you can also remove short positions, meaning that the funds won't be used again to open the same position.

When using "Auto close shorts within X time" or "Close short based on strategy", you could enable "Do not buy back on loss" to ensure you don't pay more for the same amount you previously owned of this currencies.

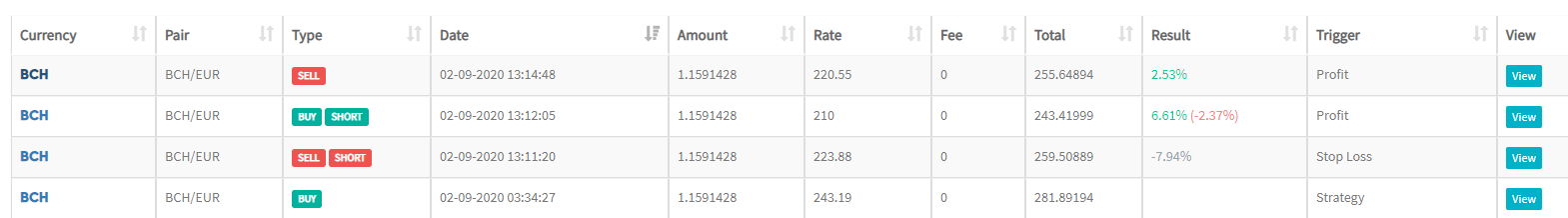

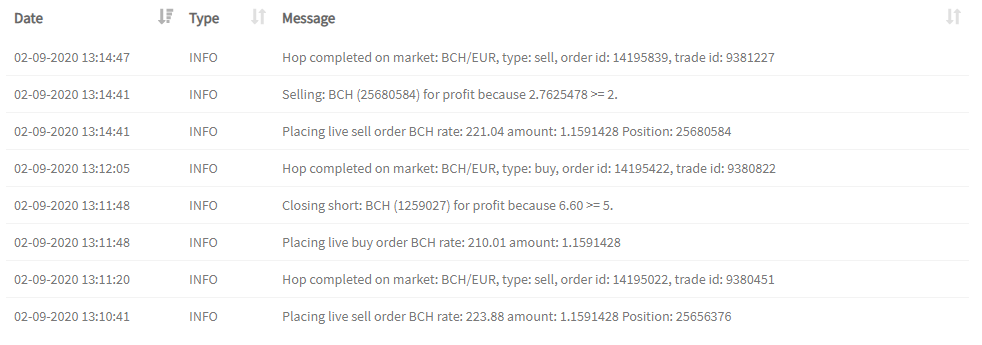

BCH: Always short instead of sell

The original position of BCH was opened by meeting the regular strategy settings of the Base config. It was sold when the stop-loss requirements were met with a loss of 7.94%; this resulted in the opening of a short position in Cryptohopper.

There is only 90 seconds between the sell that was triggered by the stop-loss and the closing of the short. The profit made on the buy quickly passed 5%, and an order was created.

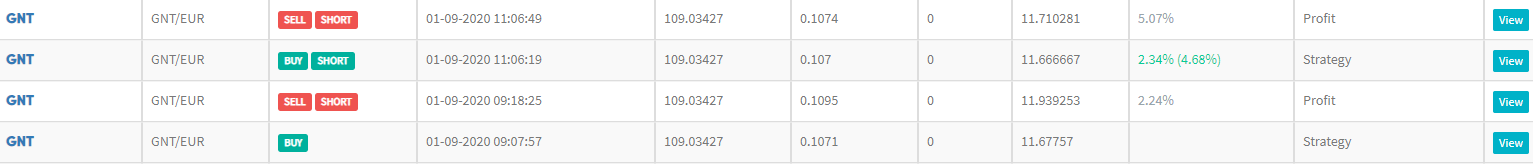

GNT: Open short based on strategy

The strategy of the base config opened the original position. It soon met the profit requirements, the position was sold, and a short position was opened. The second time the bot bought GNT, the rate was almost exactly the same as during the first buy, but since the bot kept tracking the currency, it quickly made another 2.2% profit by buying back GNT.

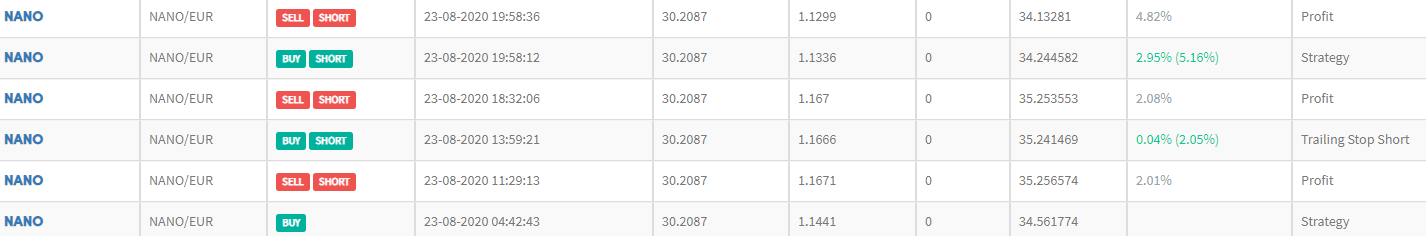

NANO: Trailing stop-short

The shorting process can continue as long as your "remove short after X time" or "Do not buy back on loss" has been triggered. The example above shows that NANO kept being bought and sold with a profit. Afterward, the short position was open for too long, and it was removed, stopping the shorting process.

It is recommended to use shorting first in a paper trading bot to experience how the different settings impact your trading.

DCA

Dollar Cost Averaging (DCA) is a tool to get rid of bags (loss-making positions), as well as a great strategy to have a better buying price over a longer period.

Beginners can use DCA to invest over a longer period gradually, i.e. you invest $1,000 in every 30 days for five months. If prices at the end of each month were $100, $90, $80, $70, and $95, your average asset price would be $85.5. If you invested the full amount initially, you would've paid $100 per currency.

Some use DCA as the "Martingale technique", which you use when a position is in a deep loss. The assumption is that a crypto price will rise eventually, so if you keep doubling your investment, your average buy price will be lower, and you will make a profit sooner when the price rises again. You do need deep pockets for this technique, as you will need to keep doubling down on your investment.

DCA doesn't have many configurable options, which makes it an easy tool to set up.

Order Type

Select what order type your bot should use for buying. Market orders will be filled immediately, but could result in lower profits or bigger losses. Especially when there’s low volume or high volatility in the market. Limit orders are orders for a specific price that take longer to fill.

DCA after X time open

Select the timeframe after you want to create a DCA order for your position. This is brilliant if you're a beginner and want to accumulate Bitcoin (or another currency) over a longer period.

DCA max retries

Fill in the maximum of DCA orders that your bot can create for a specific currency. The count is reset after every successful sell of a DCA order. Important: don’t set this number too high. It could result in even higher losses (in the case you're using it as a tool against positions).

DCA set percentage

Fill in the percentage the price must fall before your bot should place a new DCA order. Enter a positive number. You can use this as an alternative for Shorting or a Stop-Loss. This can be expensive. Important: When a new position is created/merged after your DCA order. Your position needs to go down with the configured DCA percentage again before it triggers again. It can happen that your DCA successfully finishes its action later than configured, due to a limit order that isn't filled. Consider using market orders or systematically offering a higher bid on your order (offer more than the asking price).

Whenever a new position is created/merged after your DCA order, your position needs to go down with the configured DCA percentage again before it triggers again. It may happen that your DCA successfully finishes its action later than configured, due to a limit order that isn't filled. Consider using market-orders or systematically offering a higher bid on your order (offer more than the asking price).

DCA buy immediately

Switch the toggle to trigger the buy immediately. It will be triggered when the Percentage loss hits or your Strategy signals a buy. Important: the bot will buy without any Strategy and can buy at an unfavorable time.

DCA Order Size

Select how big the orders need to be. The bigger the more loss you have when the price drops even further. There are 3 options:

Double down: This will open a DCA order with the same amount as you have in all open positions for a specific currency.

Triple down: This will open a DCA order twice as big as all your current open positions of a particular currency.

Customer percentage: Choose your percentage.

Get the latest information about your DCA when clicking on the "view" button of a position.

How is DCA calculated when positions are merged?

The current average rate is calculated by combining the costs and amounts, which have to be divided. Since DCA merges all existing open positions, the calculation could involve multiple costs and multiple amounts.

Let’s say you bought Bitcoin when the price was at $10.000. The price dips to $9.000, so you repurchase it. If you combine your total spending and divide it by the number of currencies you've bought (2 in this case), you'll have your average buy price. $10.000 + $9.000 = $19.000. Divide $19.000 by the 2 Bitcoins you've bought, and you get your average buy price: $9.500.

If you've enabled automatic DCA based on a percentage, this means if your new DCA position dips the amount as you have configured in the "DCA set percentage", it will DCA again and create a buy order.

Example of DCA

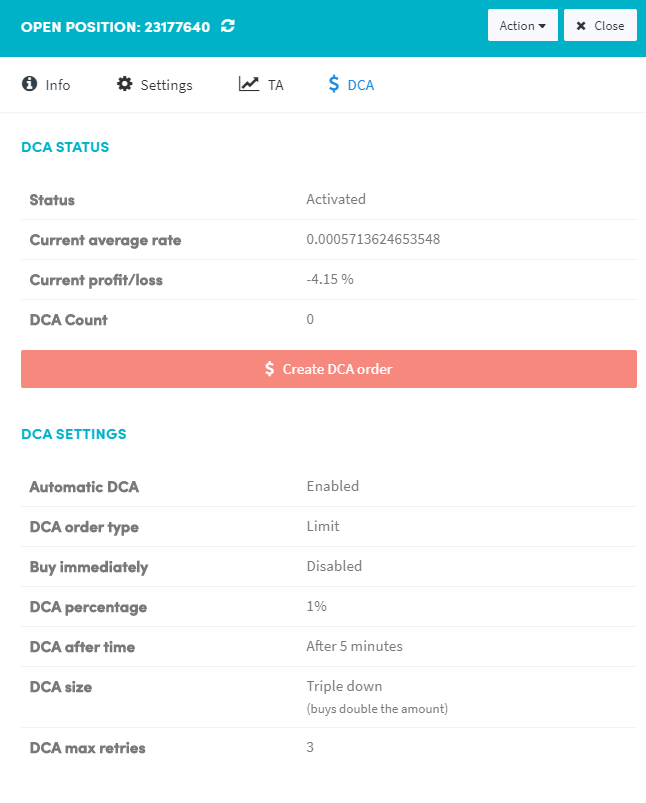

In the Base config for DCA, you can tell the bot after what percentage loss the bot should perform a DCA trade. The percentage calculation for "Current profit/loss" of DCA is based on the weighted average of all your open positions of a specific currency, excluding your reserved positions.

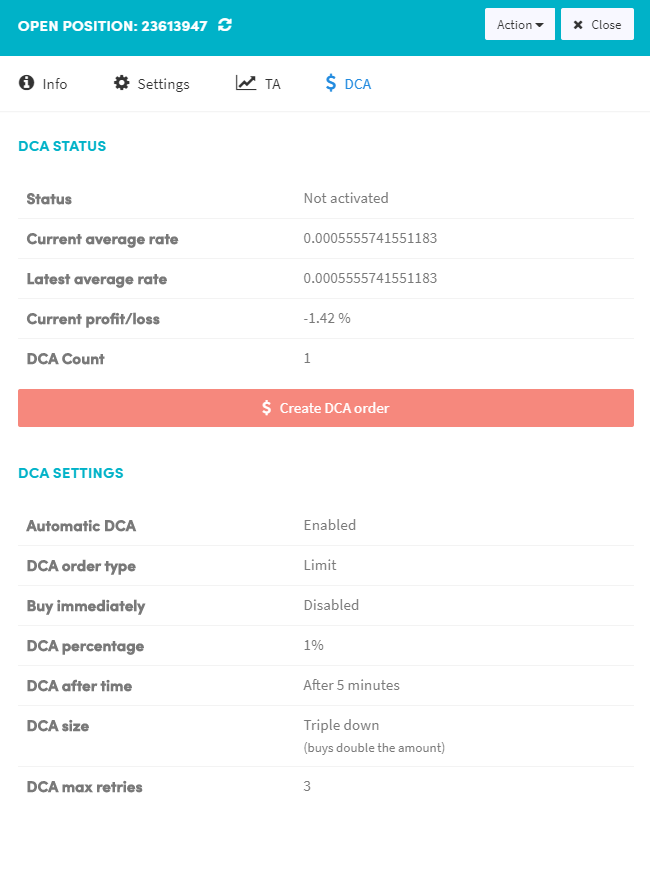

Note: since we show you a manual DCA first, don't get caught up in the automated DCA settings shown at the bottom of the 2nd screenshot. We will explain the automatic DCA settings later.

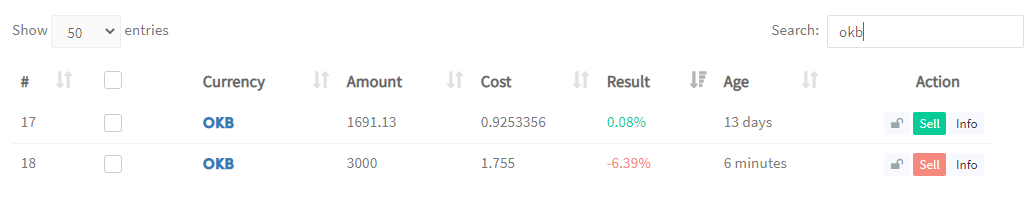

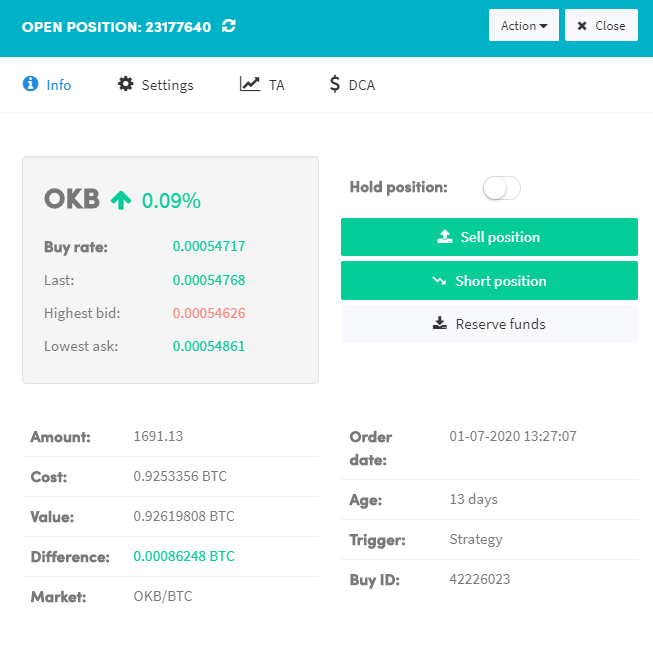

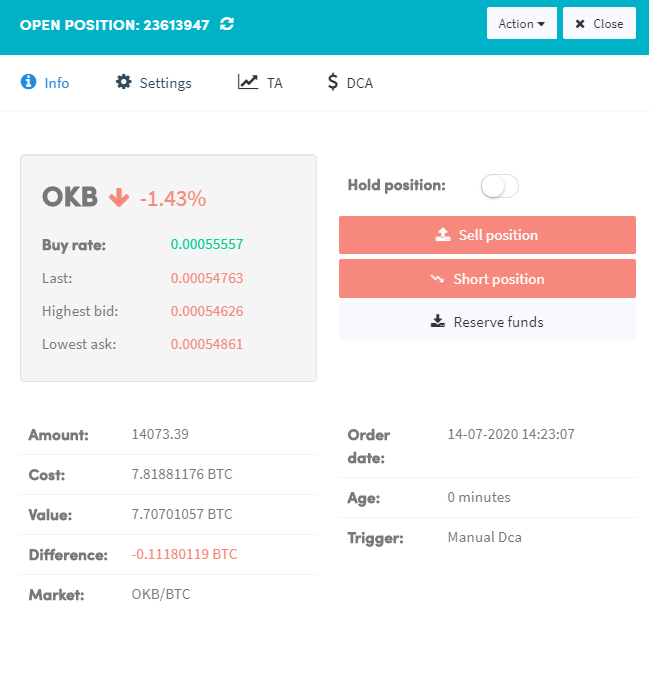

In the following OKB example, we show you how DCA is calculated and executed. The OKB example consists of 2 open positions. Keep in mind that the calculations' results slightly differ from what you see in the screenshots, due to the constant changes in prices on the exchange. First of all, it is essential to know the current average rate, which can be found by clicking on "info" and then on "DCA".

You can calculate the “Current average rate” by combining the costs and amounts, which have to be divided by each other. Since DCA merges all existing open positions, the calculation could involve multiple "costs" and "amounts," as shown in the OKB example below.

Costs: 0.9253356 + 1.755 = 2.6803356 BTC Amounts: 1691.13 + 3000 = 4693.13 OKB Tokens 2.6803356 / 4693.13 = 0.000571119

Current average buy rate = 0.000571119

0.000571119 correlates with the amount shown in the screenshot above.

We will now show you how we get to the -4.15% loss that is shown in the DCA tab. Calculation of "Current profit/loss": = ((Current rate / Latest average buy rate ) 100) - 100 = ((0.00054768/ 0.000571119) 100 ) - 100 = (0.959* 100 ) - 100 = 95.9 - 100 = -4.1 %

The current last rate is 0.00054768 and can be found when clicking on "info" next to an open position.

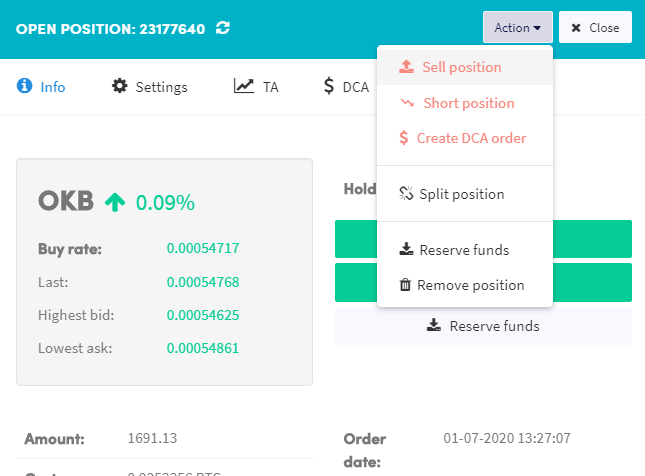

Next, we will manually create a DCA order by clicking on "Action" and then on "Create DCA order".

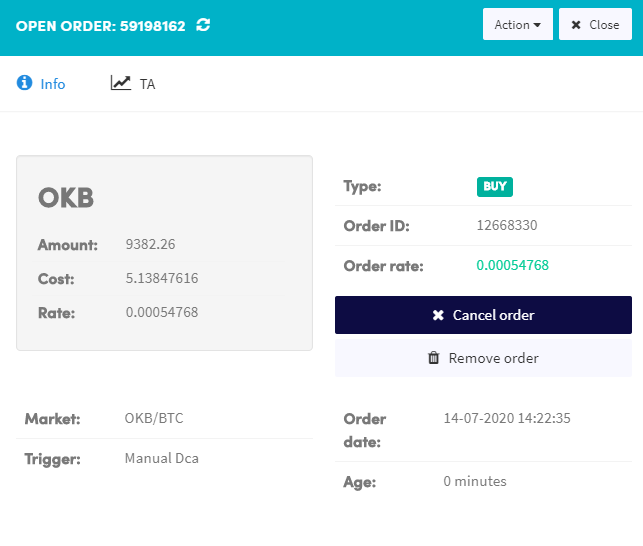

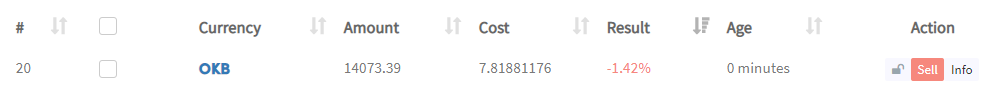

As you can see, the Trigger of the new buy order is Manual DCA. The DCA buy amount is double the amount we already owned, which we configured in our DCA settings using "Triple down". The new buy order of OKB and the current OKB positions have been merged into one new position. The new average Result after the DCA is -1.42%.

Now, let’s look at what you need to let the bot perform DCA trades automatically.

Important: For the positions that have opened a DCA trade already, the configured DCA percentage needs to be subtracted again from the current loss percentage shown. In our example, it means the following:

Current profit/loss: -1.42% DCA percentage: 1%

Minimum requirement for current loss of the next (2nd) DCA trade: -1.42% - 1% = - 2.42%

For our OKB example, the next automated DCA trade will happen when;

- The "Current profit/loss" is -2.42% or lower.

- Buy immediately is disabled. Therefore, a buy signal of your strategy is needed.

- The open time of the newly merged position should be at least 5 minutes.

- Since we have 3 retries of DCA configured, the bot can perform DCA another 2 times.

Calculation of the next DCA rate

For this explanation, we will exclude all other DCA settings to show you what the next DCA rate will be. Our example will show what the average BTC rate per OKB token must be before a new order can be placed.

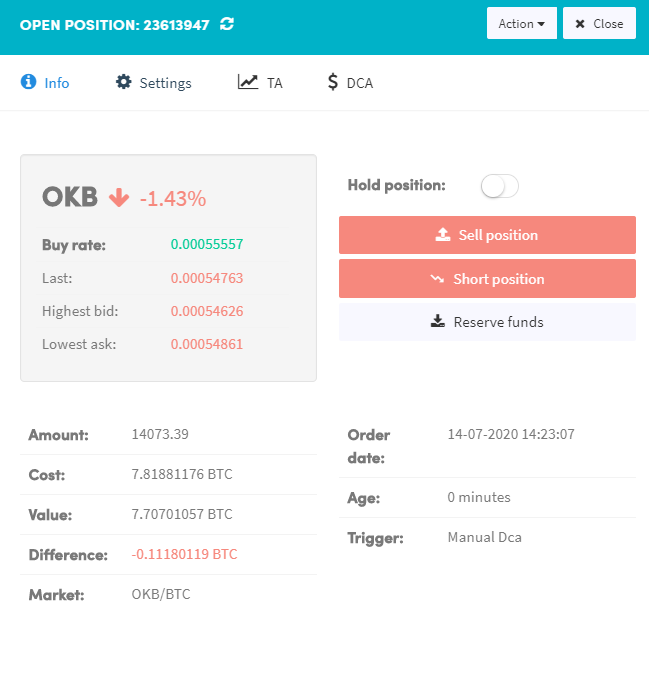

The screenshot above shows that there is a difference of -0.11180119 BTC. Value: 7.70701057 BTC Cost: 7.81881176 BTC

When you divide the Value by its Cost you can see that we get the "Current profit/loss" percentage:

= ((Value/Cost) 100 ) - 100

= ((7.70701057 / 7.81881176) 100 ) - 100

= ( 0.9857 * 100 ) - 100

= 98,57 - 100

= -1.4299%

Value needed for the next DCA trade =

= ( Cost / 100 ) (100 - Needed Current profit/loss)

= (7.81881176/ 100) (100-2.42) =

= 0.0781881176* 97.58

= 7.629596

The price per OKB Token comes down to 7.629596 / 14073.39 = 0.0005421292 BTC

Reset DCA

Would you like to reset the values of DCA? Click on "Info" next to the open position, then on DCA and click on "Reset DCA for".

Troubleshooting DCA

Are you experiencing any problems with DCA? Here are some questions to help you resolve most issues with DCA.

Do you have enough allocated amount (BTC) to double or triple up?

Is the bot enabled? Is buying enabled?

Has the configured time passed? If so, is your currency hitting the percentage (%) loss? This percentage is calculated from the moment a position is created. When a position successfully performs a DCA action, it will have to dip your % loss to hit again.

Do you have a Config Pool enabled? Maybe you have different settings in your Config Pool.

Do you have Triggers that disable buying?

If your DCA not buying immediately, was there a signal from your strategy for the currency?