What are Technical Indicators

Technical Indicators are mathematical calculations based on past data of an asset. It gives insights into potential price directions.

Different types of Technical Indicators

There are 4 different types of Technical Indicators:

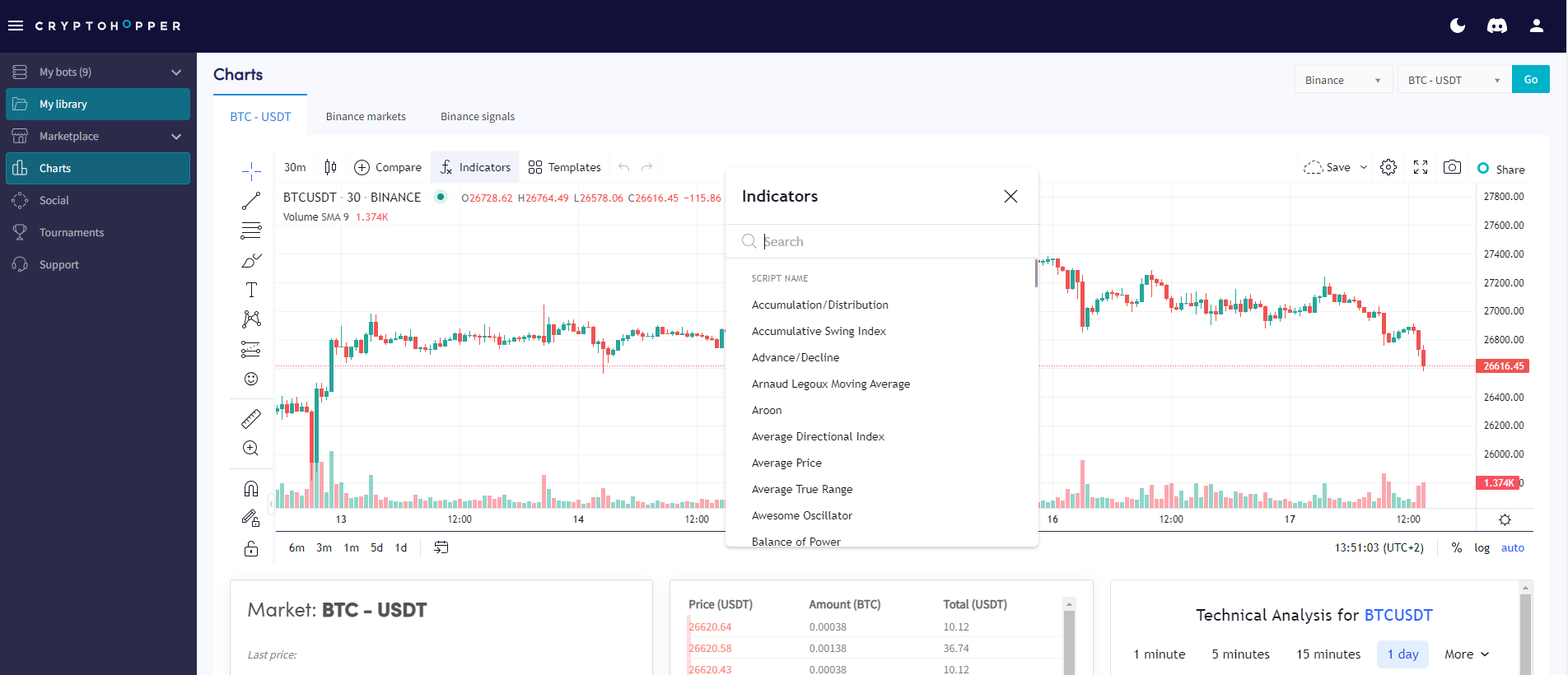

When using Technical Indicators on a chart you can select multiple Indicators.

Trend Indicators

Boil down sporadic and varying candle prices into a single uniform line. The idea is to pinpoint and follow trends to foresee how long they will continue and where they might reverse. So you can base a trading decision on that. Most of the Trend Indicators are moving averages. These are calculations that generate price averages for the last "X" periods to identify a trend line. The philosophy behind trend lines is that prices may go up and down across different candles, but if you calculate an average, you can see whether the aggregate of all candles indicates an upward trend (increase in price) or a downward trend (price decline). With this information, you can figure out when an asset will reverse in trend, or when it's ranging (moving sideways) since most of these indicators lose money when the price ranges.

The most representative indicators to identify trends are the Moving Averages. These are divided into many different types. Each has its own specifications. We have added the most used ones. For example, the Simple Moving Averages (SMA), Exponential Moving Averages (EMA), Double Exponential Moving Averages (DEMA), KAMA), Mesa Adaptive Moving Average (MESA), Triangular Moving Average (TMA), TEMA), Parabolic SAR, and WMA. For an explanation of the different Technical Indicators, click here.

Momentum Indicators

Measures the speed and strength of the price movement. It compares the current closing price with a price from a certain amount of periods ago. Momentum indicators' levels hover between 100 and 0, or around a zero line depending on the indicator. For example, if the current level is 64 and the previous one was 60, it suggests that the price is moving upwards.

Momentum indicators on their own don't provide much information about future price movements. They mainly tell us if the price is trending up or down and if it is considered overbought or oversold based on past price ranges.

We have added the most used Momentum Indicators. For example, Stochastic, RSI, StochRSI, Ultimate Oscillator, Williams %R, Chaikin A/D Oscillator, CCI, Money Flow Index (MFI), PPO, and Rate of Change (ROC). For an explanation of the different Technical Indicators, click here.

Volatility Indicators

Measure the volatility of the price. Indicating when a market is more volatile and has a higher volume. Traders love volatility. It moves the price creating trading opportunities and is usually accompanied by more volume. Markets with little volatility are considered boring and not profitable, as well as more illiquid.

We have added the most used Volatility Indicators. For example, Bollinger Bands, Average True Range (ATR), and Average Directional Movement (ADX). For an explanation of the different Technical Indicators, click here.

Volume Indicators

Indicates the number of contracts traded for a certain asset in a period of time. These Indicators will help measure the strength of a trend and its direction. Traders like volume because it creates trading opportunities. On the other hand, they try to avoid low volume periods since the price might be ranging, which may lead to either low-profit trades or negative ones.

The most used Volume Indicator is the market volume. The market volume measures the number of contracts traded in a period of time. This indicator (that actually is not an indicator since it doesn't imply any calculations) is one of the most used to analyze the market. It gives a great insight into when and where the volume appears in a market.

We have added the most used Volume Indicators. For example, On Balance Volume (OBV), Chaikin A/D Oscillator, and Money Flow Index (MFI). For an explanation of the different Technical Indicators, click here.