An example of an Algorithm Intelligence Scalping Strategy

This tutorial gives an example of an AI Scalping Strategy. This is an example, always do your own research.

Review Strategies

This is an advanced article regarding different trading styles when using Algorithm Intelligence (AI). We would recommend reading the basic documentation of Algorithm Intelligence first.

When creating a new AI, it is generally more profitable if you use the AI for a specific purpose. For example, you can create an AI dedicated to scalping or swing trading, but not both simultaneously. If a strategy is made for scalping, for example, then it usually works on a much shorter timeframe than one made for swing trading.

Signal Strategies

First, decide what type of algorithm you want. For this example, we will use a scalping algorithm, and review several scalping strategies. We have created 3 scalping strategies on Cryptohopper for your convenience. We do recommend reading the following section. However, you can also click on the names of the strategies to download them by clicking on the name of the strategies.

Combining momentum and trend indicators can work wonders. We selected the MESA on the 4h chart for this example to identify the broader trend. We then chose Williams %R to identify when the market is oversold. Last we use the crossover of the 1 and 15 EMA to determine when the momentum is back in our favor. We’re using a higher timeframe of 15 minutes. For both Williams %R, and the crossover of the 1 and 15 EMA, they tend to give out a lot of signals on the 5 minutes chart. Important: Williams %R and the EMA crossovers are very unlikely to give out signals simultaneously. That is why we have designed the strategy so that Williams %R signal is kept for 5 candles.

For the exits, we use the following sell settings: Take profit 7%, Stop-Loss 1%, Trailing Stop-Loss percentage 1%, arming 1.5%

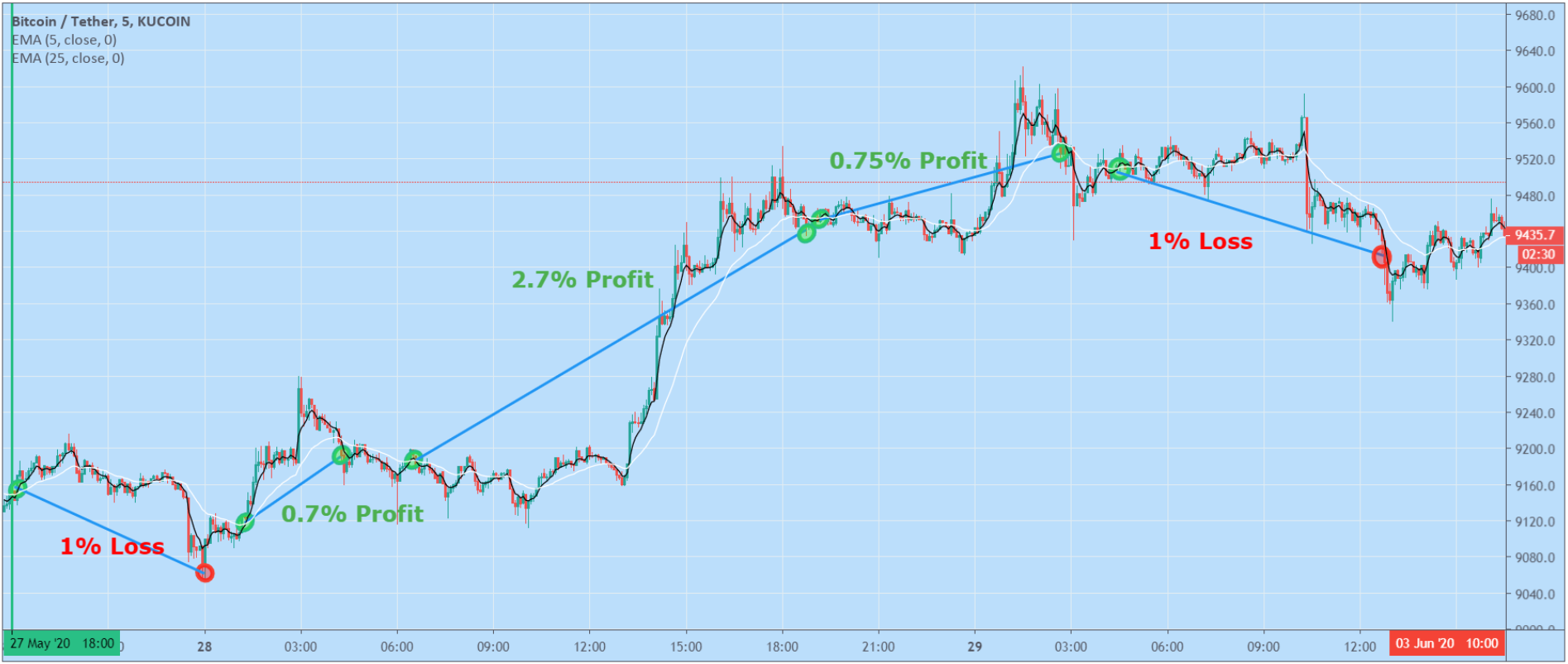

This strategy involves using trend-following indicators on multiple timeframes. It first uses the MESA on the daily and 4h charts to make sure that the trend is in our favor. Then on the 5-minute timeframe, we have the crossover of the 5 EMA and the 25 EMA.

For this strategy, we will use the same exit settings as the previous one: Take profit 7%, Stop-loss 1%, Trailing Stop loss percentage 1%, arming 1.5%

The last Strategy uses the MESA on the 4h chart to determine the direction of the trend. The crossover of the 15-50 EMA on the 5 minutes chart and the ADX value greater than 20 is then used to determine the entry.

For the exits, we use the following sell settings: Take profit 5%, Stop-Loss 1%, Trailing Stop-Loss percentage 0.5%, and arming at 1.5%

Trend Strategy

Trend Strategies usually need to keep signaling a buy in uptrends and sell in downtrends. The Parabolic SAR on the daily chart is a good example. It keeps the buy/sell signals according to the trend. However, if you add the Parabolic SAR on multiple chart periods with the option "necessary signal" active for one of the chart periods, then you will also get neutral signals. Based on this we make a simple Parabolic SAR strategy on the daily timeframe. So it doesn’t generate any neutral signal.

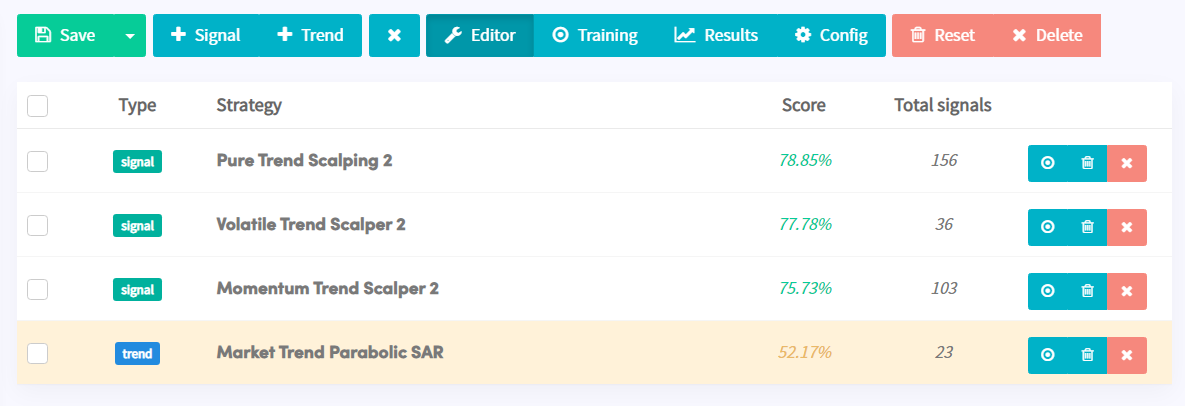

Now let's add them to the new AI to see how they perform. Remember to hit save after adding all of your desired strategies.

Strategy Config

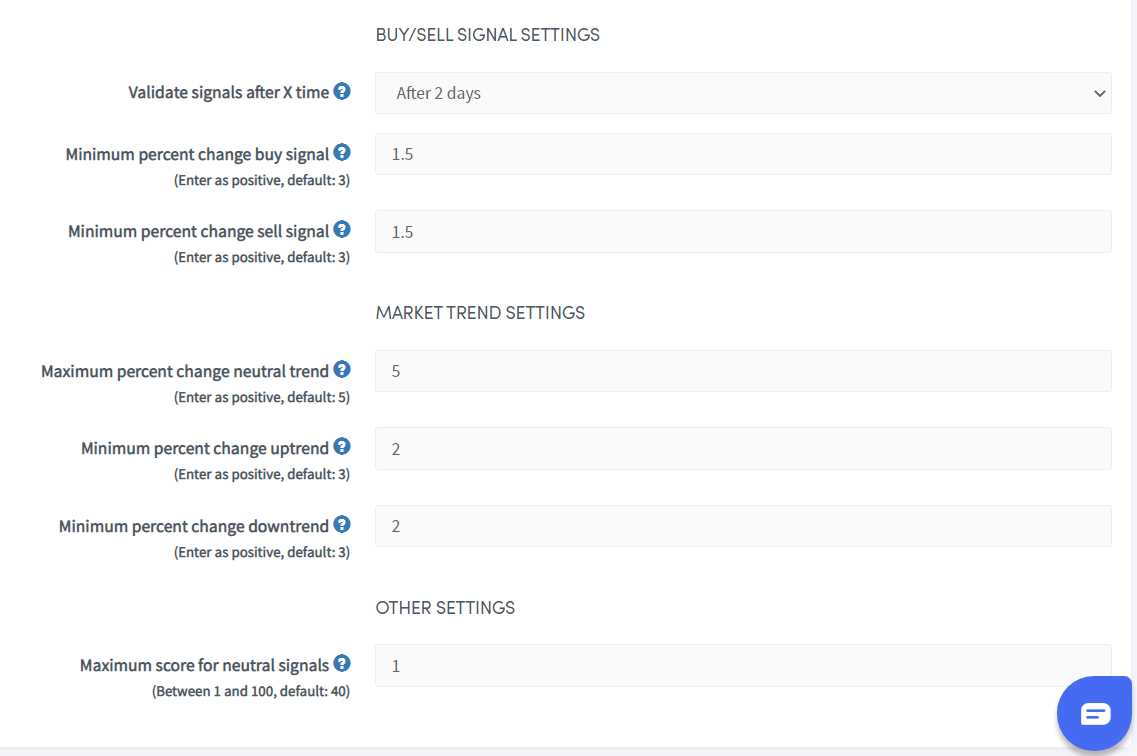

We’re using the following settings:

Validate signals after X time

Scalping is usually done within 24 hours. It’s short-term day trading. Due to low volatility, 1 day can be too short to reach the profit target. That’s why we choose 2 days.

Minimum percent change buy signal All of our Strategies rely on a Trailing Stop-Loss armed at 1.5%. That’s why we use 1.5%, as this is the minimum threshold for a positive trade.

Minimum percent change sell signal We have also selected 1.5%. In our Strategy, this is not important, because we don’t use any selling indicators. We’re selling with the sell settings.

Maximum percent change neutral trend We use the default of 5%. This is not important because we’re using a trend strategy that doesn't provide any neutral signals.

Minimum percent change uptrend We use 2% here. The trend Strategy should experience a more significant move than the Strategy itself.

Minimum percent change downtrend We use 2% here. The trend Strategy should experience a more significant move than the Strategy itself.

Maximum score for neutral signals We use 1 here. This is not important, because we don’t use any neutral signals.

Training

Since we have only analyzed how the strategies behave on BTC/USDT, we have chosen the pair BTC/USDT to have the most accuracy. Since these are scalping strategies, we should still have enough signals to get an accurate picture of how well they can perform.

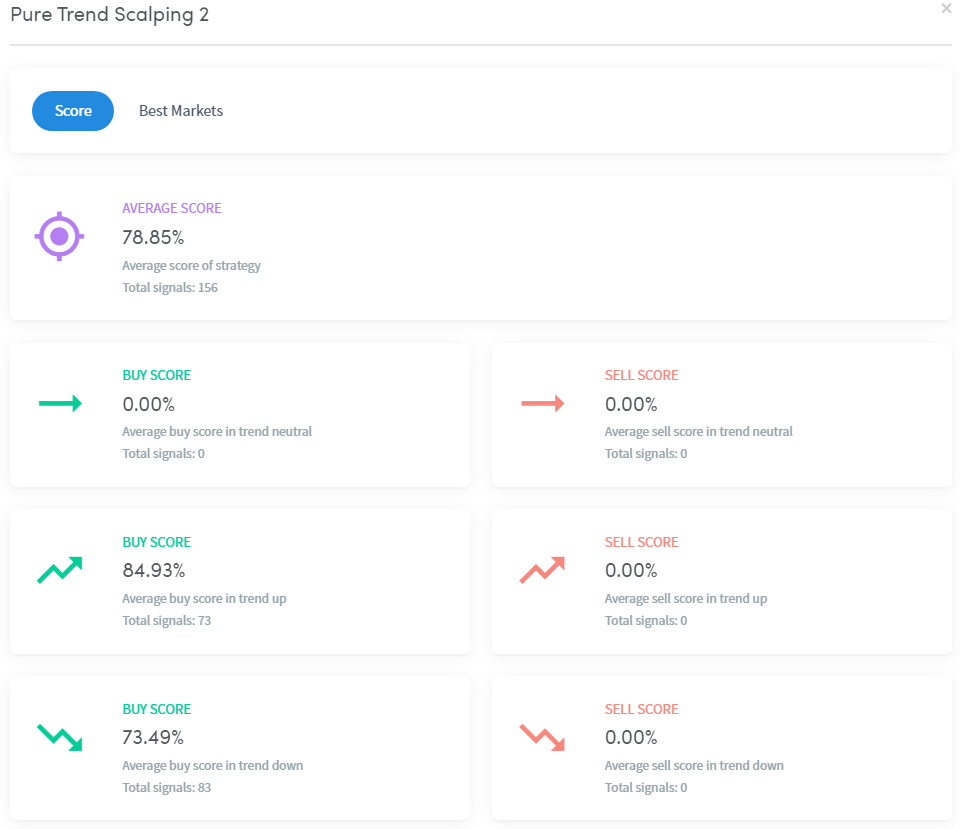

When the training is done we can see the results. The scalping Strategy has performed well. More than 75% of the trades reach the 1,5% mark.

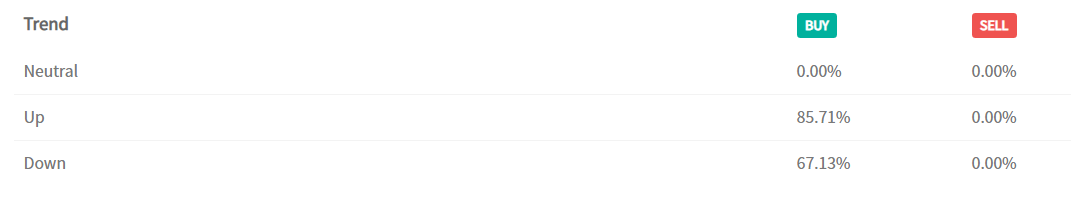

We receive a lot of signals. Almost 200 in total. Click on the Strategies to see the details. You see that the winning % is more significant in an uptrend market than in a downtrend (hence why the signals had the MESA as a filter initially).

You can also see this in the results by "Trend" in the "Results" section. The uptrend signals are around 20% higher than the downtrend ones.

Baseconfig

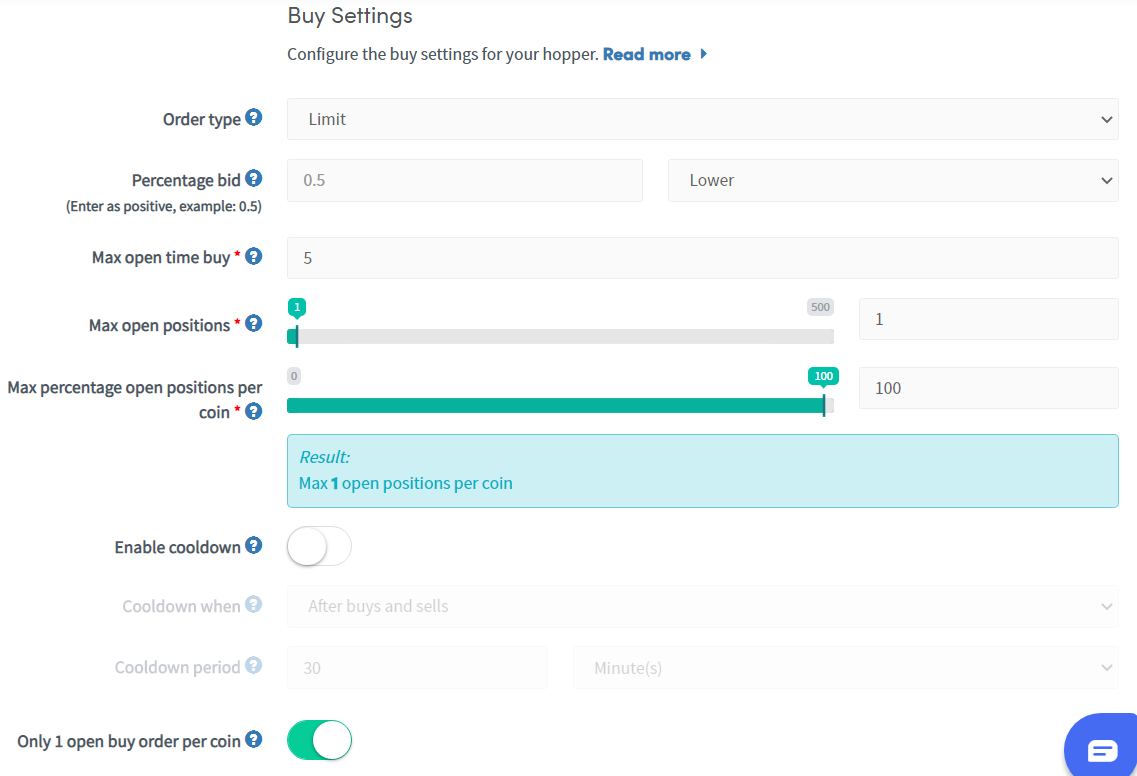

Buy settings

Order type

We use limit orders because we have a scalping bot. With scalping a small difference of 0.01% per trade is significant.

Max open buy time

We use 5 minutes. We don’t want to get in a trade an hour after the opportunity was found.

Max open positions

We use 1 because we only trade against BTC and don’t use DCA. When trading more currencies, you can select more. "Max percentage open positions per coin" and "only open 1 position per currency" were also set accordingly.

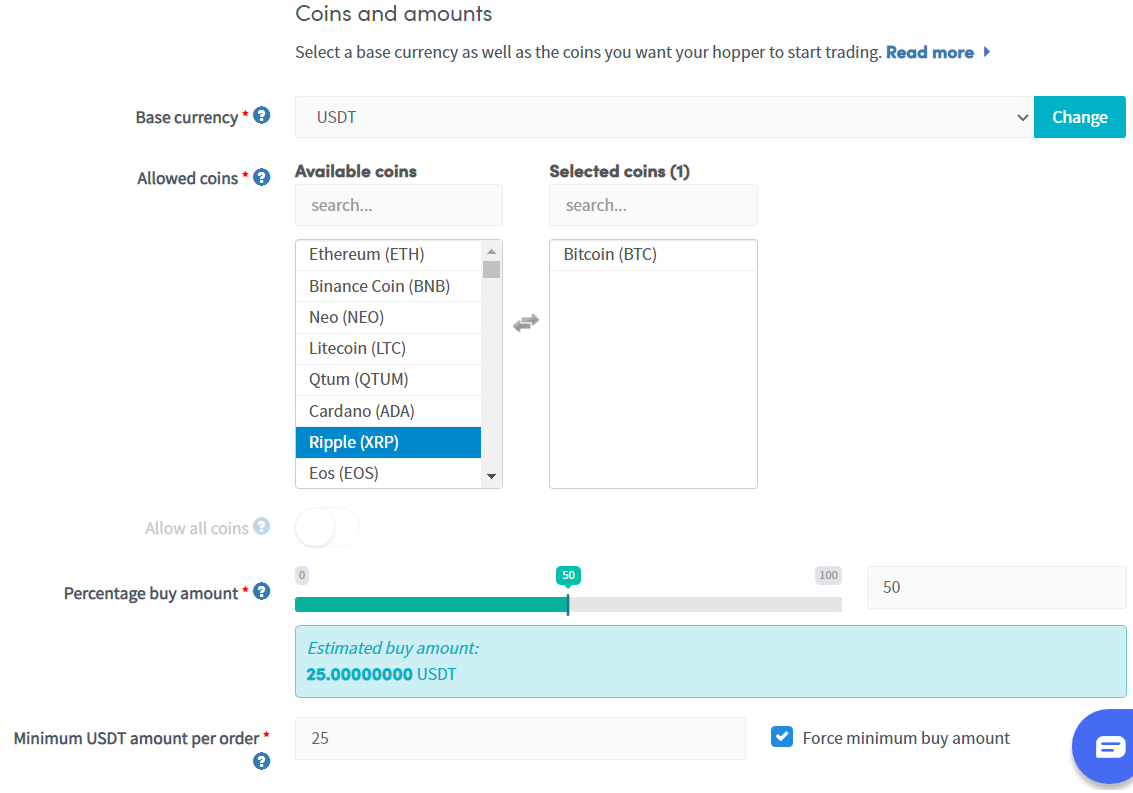

Coins and amounts

Quote currency

We use USDT because our AI trained our Strategies against USDT.

Percentage Buy amount

We configured to only open 1 position at a time on BTC, so we use 50% here. If you are new to Cryptohopper and trading you want to select a smaller %. So you can learn, before risking large amounts of your capital. You can also trade with all of your funds at once. If you do this, make sure to select 98% and not 100%. You need to leave some free funds for the fees.

Minimum USDT amount per order

Fill in more than the minimum required by your exchange.

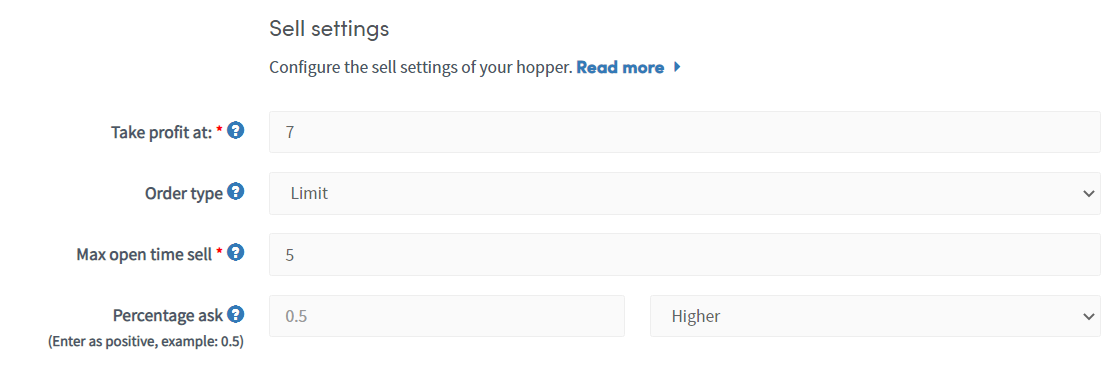

Sell settings

Take profit

We used 7% "take profit" for most of the Strategies. So we’re using it also with the scalping bot.

Order type

We use limit orders because we have a scalping bot. With scalping a small difference of 0.01% per trade is significant.

Max open time sell

We use 5 minutes. If the bot is unable to sell the position in 5 minutes at a specific price. We want the order to be canceled and try to sell again at another rate.

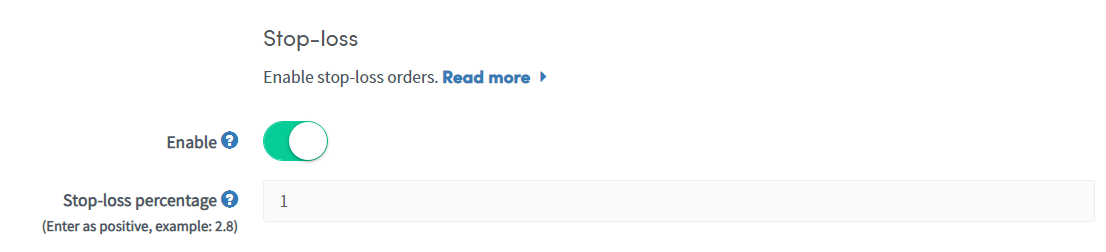

Stop-Loss

Stop-Loss

We use 1%. The same percentage we used for the Strategies. You can test wider settings and see how that works.

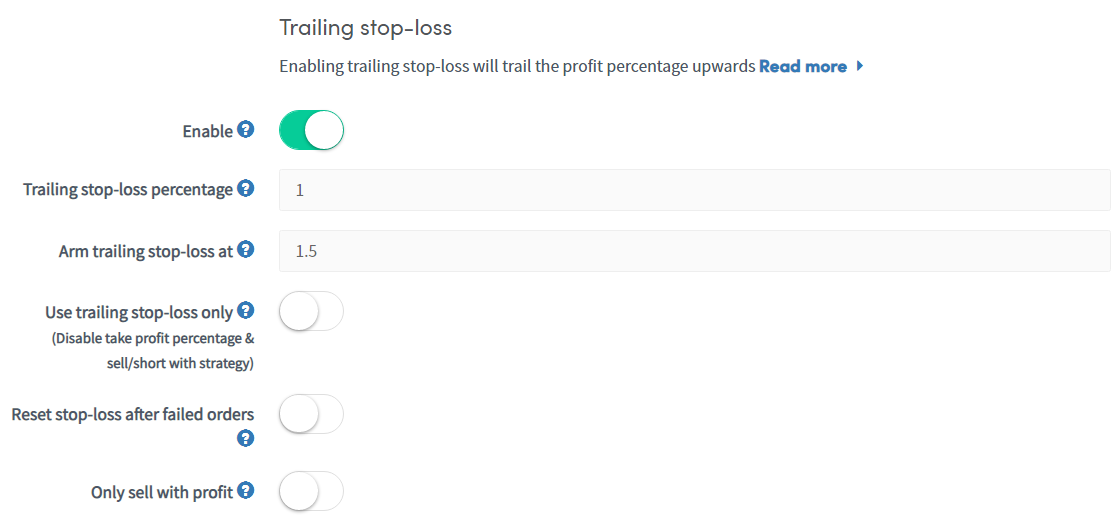

Trailing Stop-Loss

Trailing stop loss percentage

We use 1%. It gives the currency room to grow but also locks in profits once it is armed. You need at least 1,5% as the arming level and use an exchange with low fees.

Arm Trailing Stop-Loss

We use 1,5%. We have trained the AI with 1.5% and our Algorithm is based upon our Strategies reaching 1.5% every time.

Strategy settings

Strategy

Select the AI that you have created and trained. We use the "Scalping Bot Example".

Signals only

We want to use our AI so this is disabled.

Number of targets to buy

We use 1 because we have 1 open position at a time and 1 currency.

Use corrected score for buys/sells

"Yes" is usually the better choice here. It takes your real-time data into account and allows your AI to improve. So we use “Yes”.

Minimum score for buys/sells

A decent choice here is around 80%. You want to be selective with the signals your AI acts on for the best profitability.