An example of a Strategy built with the Strategy Builder

This tutorial shows an example of a Strategy created with the Strategy Builder.

Example Strategy

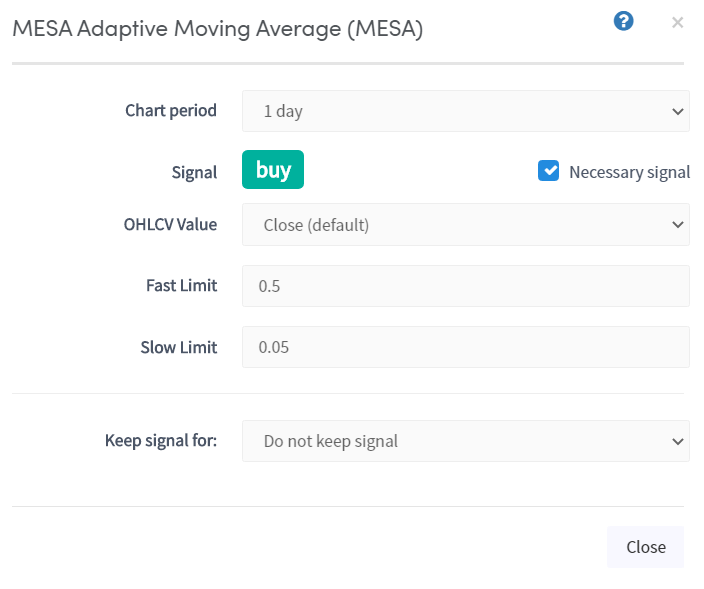

We’re going to give you an example of how to set up a Strategy with the Strategy Builder. Important: this is an example. Always do your own research. For this example, we will identify a bullish market with the MESA daily chart. This is what the MESA looks on the chart:

The MESA will indicate a bullish market as long as the cloud is green. For more information about indicators, click here. This is what it looks like when using Cryptohopper:

Chart period

Select the timeframe you want to use. This is the candle size the Indicator operates on. In our example we use a candle size of 1 day. You can choose between 1 day and 1 minute.

Signal

Select buy or sell. In our example we selected buy.

OHLCV Value

Select the value. This is a unique setting for the MESA Indicator. In our example, we selected Close (default).

Fast Limit

Fill in the limit. In our example, we keep the default of 0.5.

Slow Limit

Fill in the limit. In our example, we keep the default of 0.05.

Keep signal for

Select the specific number of candles. You can also choose Do not keep signal. When you have multiple indicators and 2 of them have to give a buy signal. Not all indicators will signal a buy simultaneously. The signal will remain for the number of candles you selected. The time the signal is shown depends on your candle size and the number of candles. In our example, it is not necessary for the MESA.

Necessary signal

Check the box if you want the indicator to indicate a buy each time we enter a position. This option is useful when you have a Strategy of 6 indicators, but only need 4 indicators signaling a buy simultaneously to enter a trade. If you would like to have 1 out of the 4 indicators active at all times, tick this option.

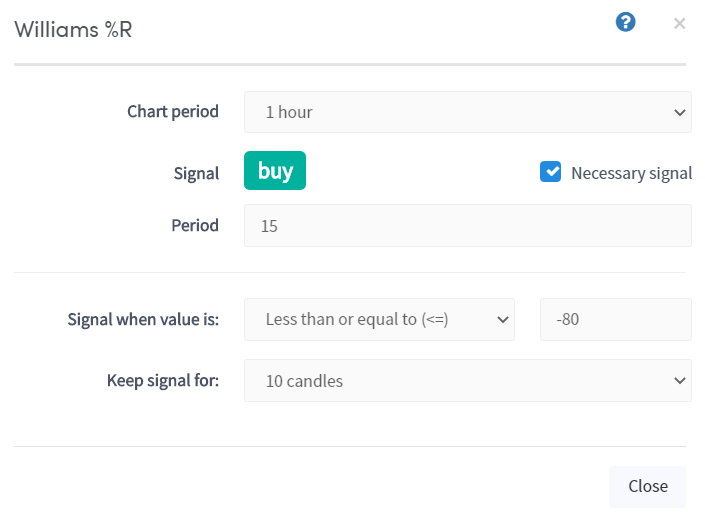

For our example, we will identify a bearish market with the William’s %R 1-hour chart. This is what the William’s % R looks on the chart:

The indicator will identify a bottom each time the black line falls below the lower band at -80. The green circles indicate the bottom on the graph. William’s %R can find some great buy points in a bullish market. However, it has some significant drawbacks. When the market crashes, the indicator would indicate a buy continuously. As a result, you may enter a position, only to have the market continue falling a lot further. So we combine this indicator with another indicator. This is what it looks like when using Cryptohopper:

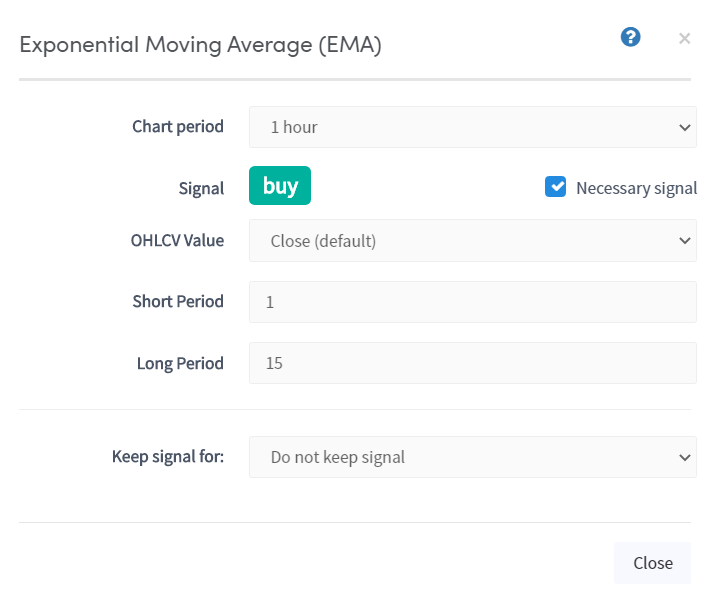

Let's now add an indicator that can complement the William's %R indicator to confirm a buy signal. A crossover of the 1 and 15 EMA can work well in identifying when the trend is bullish again. This indicator produces "buy signals" each time the fast EMA crosses over the slow EMA, as shown on the chart.

This is what it looks like when using Cryptohopper:

We choose to keep William's %R signal for 10 candles. It’s very rare for Williams %R to be oversold while the EMA crossover indicates a bullish signal. The vertical green line at the left presents the moment the MESA turned bullish on the daily chart.

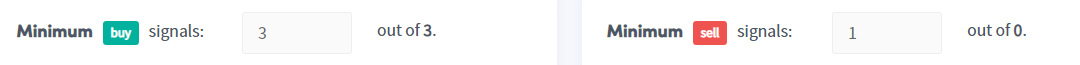

We have set the minimum "buy" signals to 3 out of 3. This means that all of the indicators are necessary for your bot to make a trade.

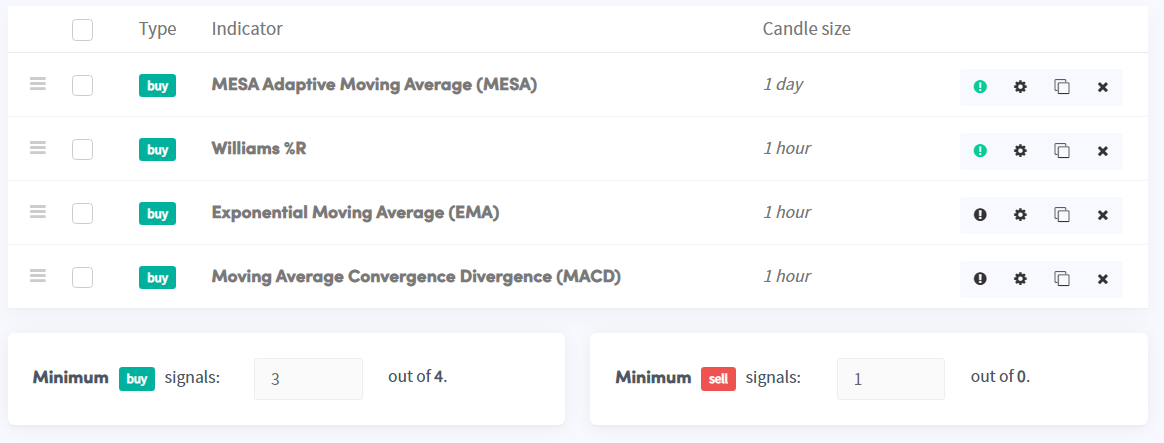

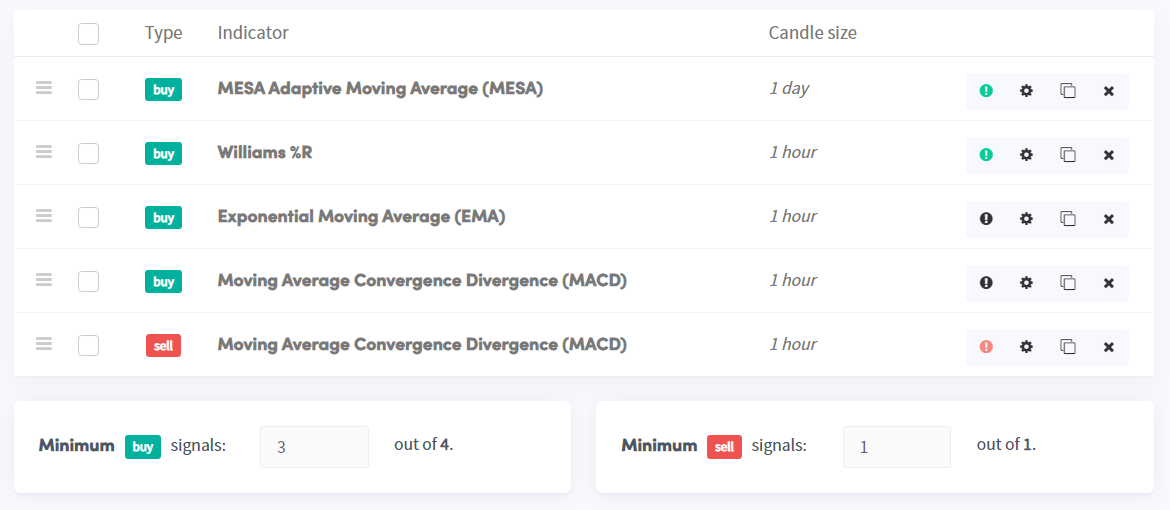

This feature is useful if you have many indicators. Not all are essential to the strategy, and some are substitutes. For example, you consider the MACD as a substitute for the EMA and not essential to the strategy. You will have 3 out of 4 minimum buy signals. You still have the MESA and Williams %R set as necessary, while the EMA is no longer necessary. In the end, you need the MESA and Williams %R to indicate a buy signal, and then you need either the MACD or the EMA to indicate a buy for your bot to open up a position.

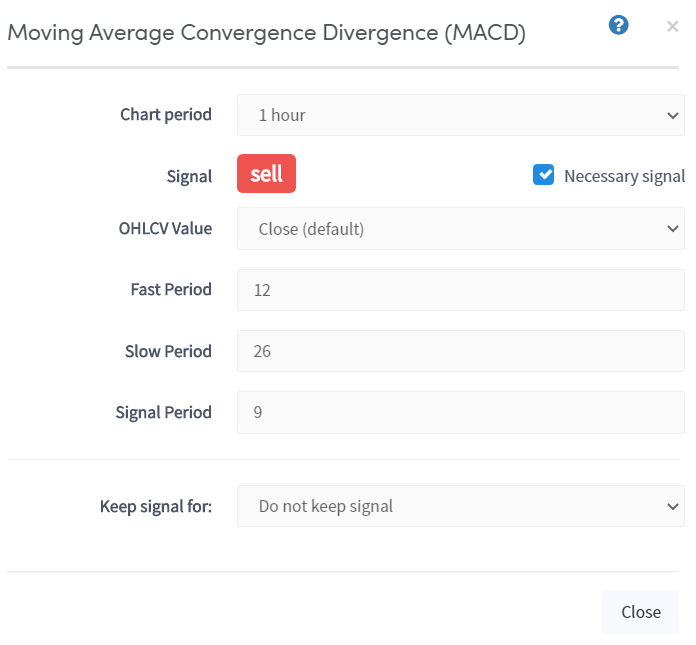

Let’s add a sell indicator to this strategy to close positions. The MACD on the hourly chart should work here. To create a sell indicator instead of a buy one, simply click on the green "buy" button in the menu of the particular indicator. This will change your signal to "sell".

This is what it looks like when using Cryptohopper:

This is what the final version of the strategy looks like:

This is what the final version of the strategy looks like: