Mastering Cryptocurrency Trend Trading, A Beginner's Guide to Profitable Strategies on Cryptohopper

Are you ready to embark on a journey through the fascinating realm of cryptocurrency trend trading? If you're looking for a more relaxed yet potentially lucrative approach to the crypto market, then buckle up because we're about to dive into the world of trend trading.

So, what exactly is cryptocurrency trend trading? Well, it's all about identifying and capitalizing on long-term market trends. Instead of getting caught up in the day-to-day fluctuations of the market, trend traders aim to ride the waves of larger, more sustained price movements. It's a strategy that requires patience, discipline, and a keen eye for spotting emerging trends.

One of the key principles of trend trading is riding the trend for as long as possible while it remains intact. This means entering positions when a trend is confirmed and holding onto them until there are clear signs of a trend reversal. It's all about maximizing profits by staying in the market for the duration of a strong trend.

When it comes to executing trades, timing is crucial. Trend traders often rely on a combination of technical indicators and chart patterns to confirm the strength of a trend. Technical indicators like moving averages, MACD, MESA, and the Parabolic SAR are great examples of trend-following indicators that can be used in identifying potential entry and exit points.

Let’s look at an example of a trend-following strategy that you can use to trade on Cryptohopper. Furthermore, to simplify things, let’s focus on a single cryptocurrency, namely Cardano (ADA).

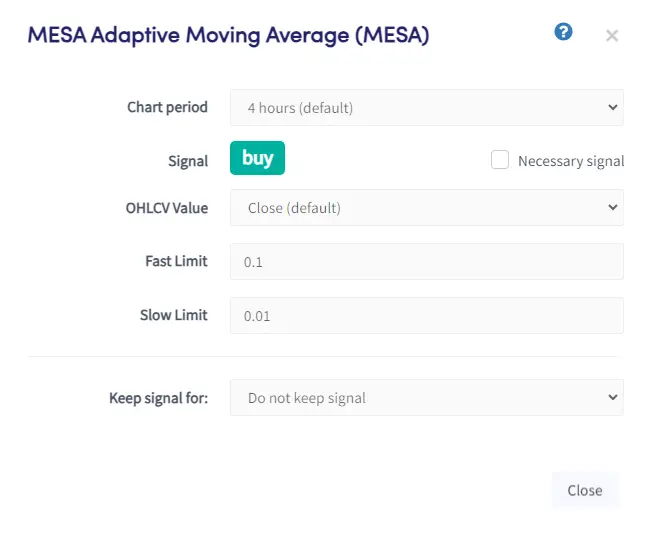

Let’s combine two trend-following strategies, namely the MESA and the Moving Average Convergence Divergence (MACD). The MESA is a trend-following strategy that sends a buy signal for as long as the MAMA is above the FAMA. On the chart, this will look like a green cloud.

The MESA will then send a sell signal for as long as the MAMA is below the FAMA, and on the chart it will look like a red cloud.

This essentially makes the MESA a sticking indicator, meaning that it will continue to send the buy or sell signal for as long as the condition is met.

This feature makes the MESA an excellent indicator that can be utilized as a filter and combined with other indicators. A filter serves as an indicator designed to "filter out" poor trading signals from other indicators. The filter aids in identifying the overarching trend, enabling the utilization of another indicator to capitalize on buying low and selling high within the overall trend.

However, given that the MESA will serve as a filter, we need to adjust its default values; otherwise, the indicator would prove too restrictive, resulting in very few trading opportunities. Consequently, we will modify the default value of the Fast Limit to 0.1 and the default value of the Slow Limit to 0.01.

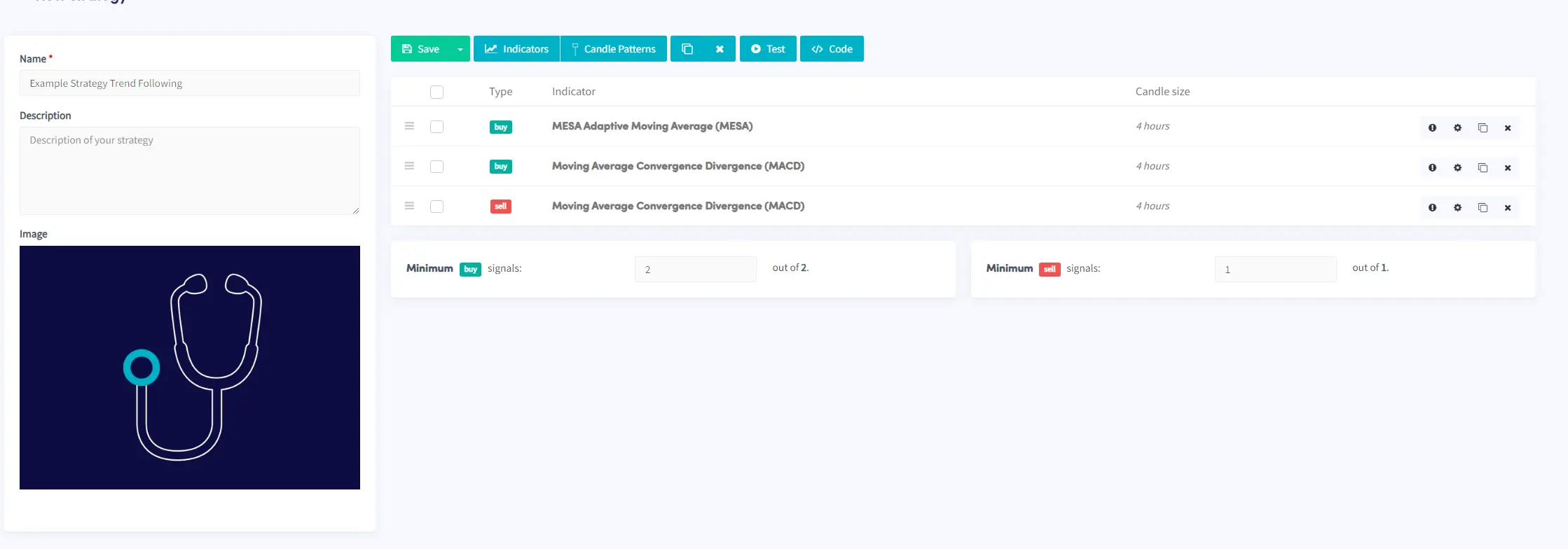

Thus, the setup on Cryptohopper will appear as follows:

Since we will only use the MESA to filter out buy signals, we will NOT add it again to signal a sell as well.

Additionally, you may have noticed that we kept the Chart period at 4 hours, which is the default setting. This decision is made because trend-following indicators tend to perform better on longer timeframes, such as 1-hour or above. Therefore, the 4-hour period is an optimal choice in this regard.

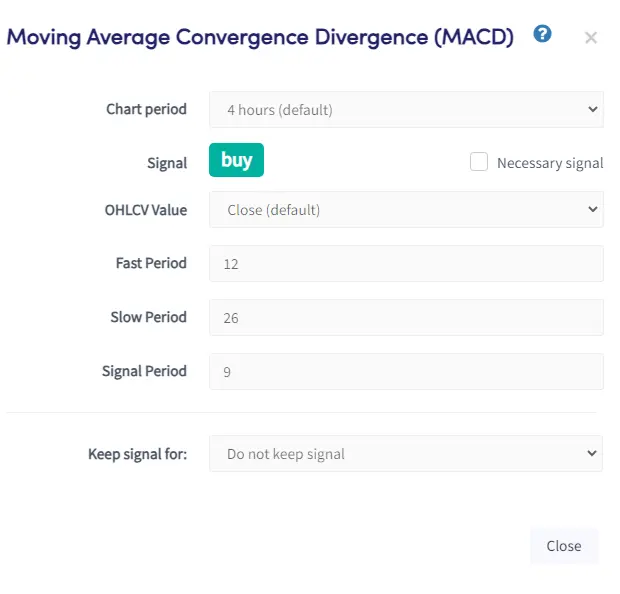

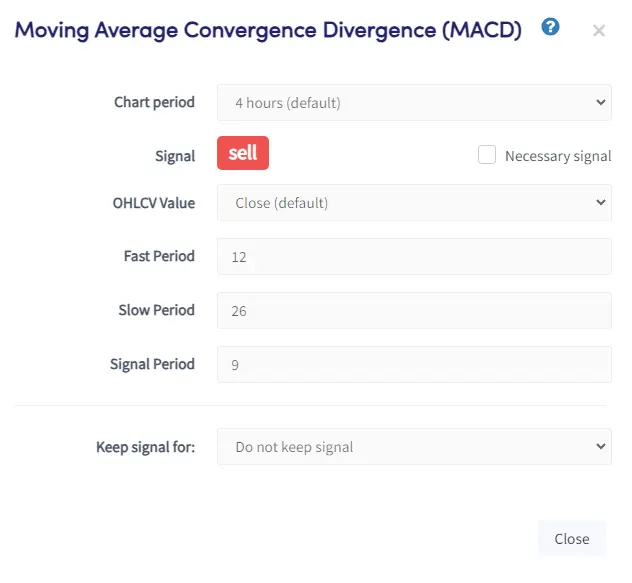

Now that we have established our filter, we will require another indicator to pinpoint our entry and exit points. The MACD would serve as a suitable option for this purpose. The MACD issues a buy signal when the histogram shifts to green and a sell signal when it transitions to red.

It is important to note that the MACD is NOT a sticking indicator; it provides its buy or sell signal only once when the condition is triggered. This characteristic makes it a suitable candidate for an indicator used to identify buy and sell signals.

We can incorporate the MACD on Cryptohopper as follows:

Please remember that we do have to add it twice this time, once for the buy signals and once for the sell signals, as we will use the MACD to close our positions.

Also, remember to set the minimum buy signals to 2 on Cryptohopper, as we have 2 buy signals: one from the MESA and one from the MACD.

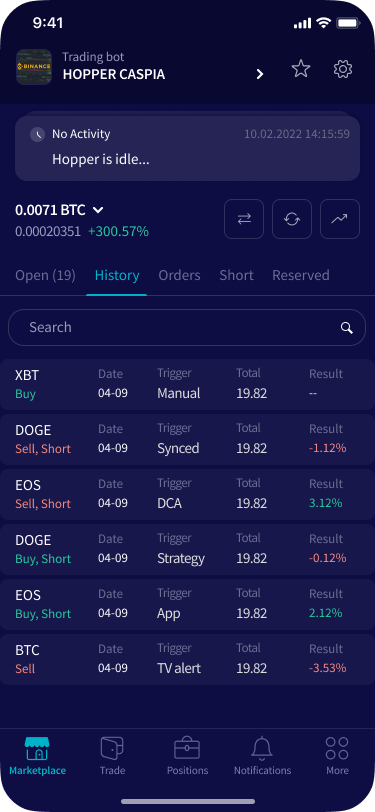

Ultimately, our strategy will appear as follows:

If you used this strategy to trade ADA/USDT from April 2018 to February 2024, you would have seen an impressive 1,023% increase. We're assuming you put all your assets into each trade and there's a 0.1% fee per trade. This beats the 79% return from just buying and holding over the same period.

It's important to remember, though, that this is based on past performance and doesn't guarantee future success. Also, we only tested this on ADA/USDT, so it might not work as well with other cryptocurrencies.

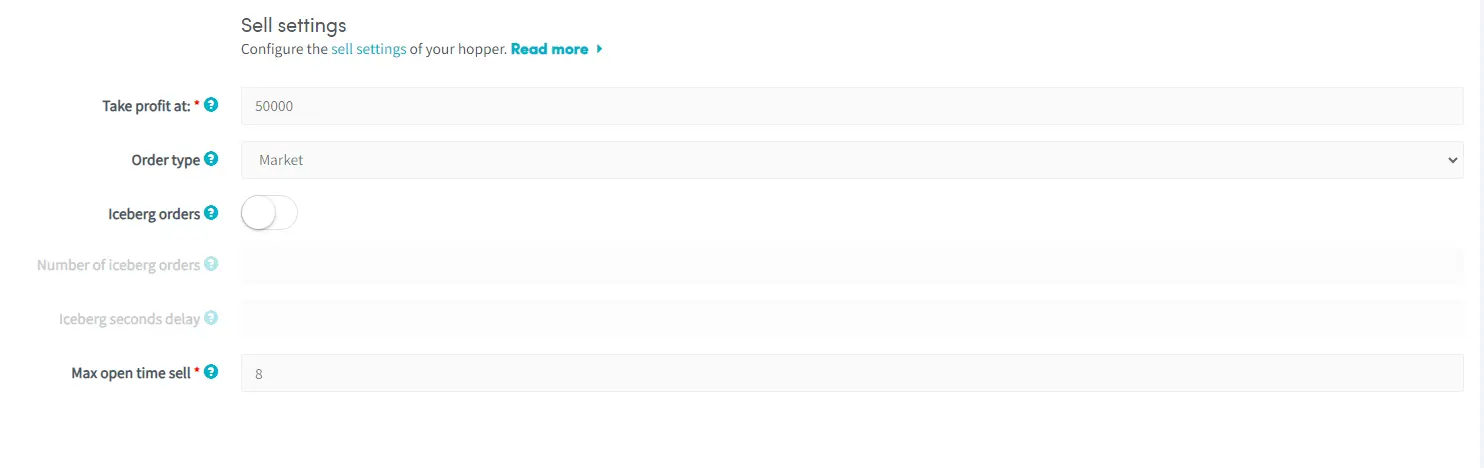

Another thing to consider in trading is your bot settings, like take-profit and stop-loss. With trend-following indicators, it's often best to skip these. That's because these indicators follow the trend, and setting fixed levels could limit your potential profits. It's usually better to let your indicators decide when to close a trade.

Some argue against using stop losses with trend-following indicators, saying that in strong trends, volatility is just noise. Using a stop-loss could exit a profitable trade too soon. So, it's often better to let your indicators close your position.

On Cryptohopper, you have to set a take-profit level, but you could set it high, like 5000, so it never gets triggered.

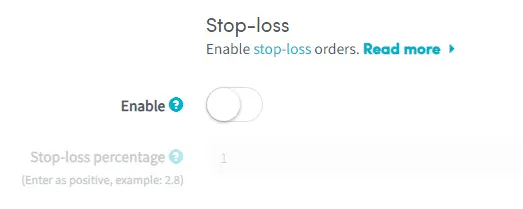

For the stop loss, you can just leave it disabled like this:

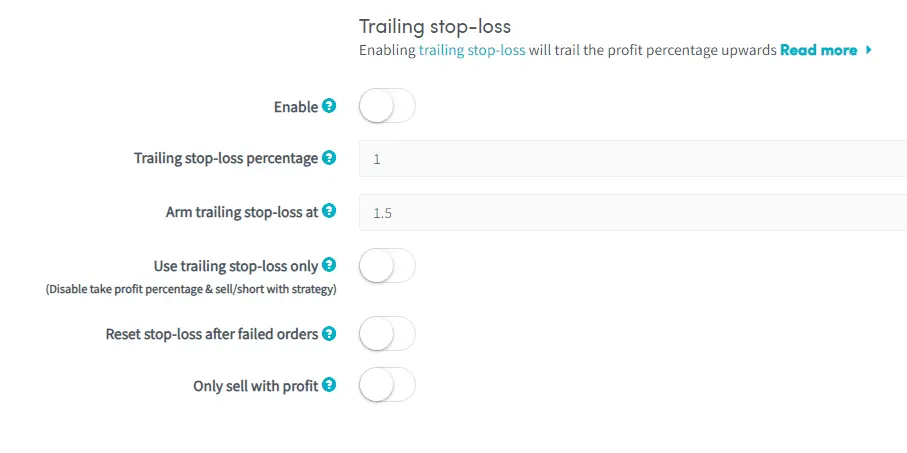

Same thing with the trailing stop loss:

Bottom Line

Trend trading in cryptocurrency offers a promising opportunity to capitalize on market trends for potential profit. By combining strategies like MESA and MACD, you can create effective filters and entry/exit signals to navigate the volatile crypto landscape.

While past performance doesn't guarantee future results, implementing sound strategies and adapting to market conditions can increase your likelihood of success.

So, with patience, discipline, and the right tools, you can confidently begin on your journey through the exciting world of cryptocurrency trend trading. Happy trading!