Switching Trading Bot Templates With Triggers

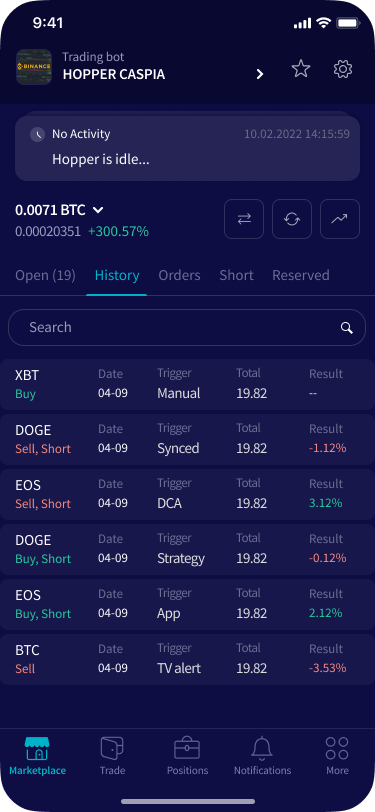

Triggers on Cryptohopper are powerful tools that allow you to automate particular actions in your trading bot according to predefined conditions. Essentially, these triggers are customizable event-based actions that assist you in managing your cryptocurrency trading more efficiently and effectively.

Triggers can be configured to execute various actions, including buying, selling, halting trades, or even changing templates for a bull market or a bear market.

What are Bull and Bear Markets?

A cryptocurrency bull market is characterized by rising prices and widespread optimism among investors, driven by factors like increased adoption, positive news, and speculative interest.

On the other hand, a cryptocurrency bear market is marked by a prolonged period of declining prices and pessimism among investors, often triggered by factors like regulatory uncertainty, negative news, or a lack of confidence in the market.

Given the substantial disparity in market conditions between a bull and bear market, it can be prudent to have two distinct templates—one tailored for the bull market and another for the bear market.

For instance, in a bull market, you can utilize Dollar Cost Averaging (DCA) to purchase more assets during temporary price corrections. This strategy anticipates quick price recoveries, allowing you to reduce your entry price.

Conversely, in a bear market, employing a stop-loss mechanism might be more advisable. In this scenario, as prices begin to decline, it's reasonable to anticipate continued drops in the foreseeable future.

Therefore, let's explore some examples that you can implement to adjust your current template according to the prevailing market conditions.

Setting Up a Trigger

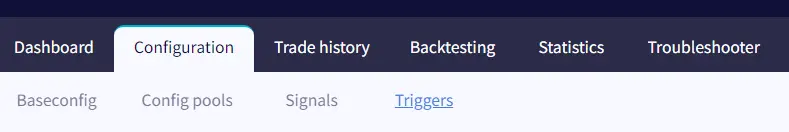

Setting up a trigger on Cryptohopper is straightforward:

Access your Cryptohopper account, and navigate to the dashboard.

From the dashboard you can then select Configuration and Triggers.

Then click on "New" to create a new trigger.

Examples of Triggers

Let’s take a look at some specific examples that you can implement on Cryptohopper.

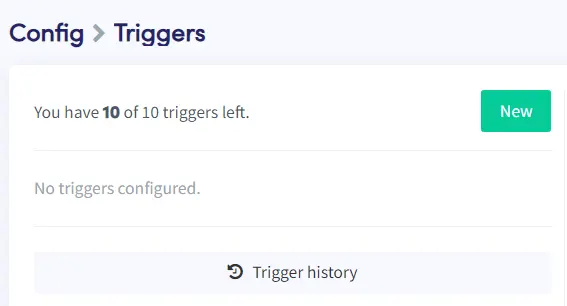

Crash Protection Trigger

An example of a trigger you can create is one that safeguards you against market crashes. The cryptocurrency market is renowned for its swift crashes, which can plummet by up to -50% in a single day for certain altcoins.

However, what's even more concerning is that a severe crash often indicates that the market will continue to decline, at least in the short term. Hence, this could serve as a signal to switch your template from a bull market to a bear market.

Crashes typically originate with Bitcoin, as its decline prompts altcoins to follow suit. Therefore, we can establish a trigger to change the template if Bitcoin experiences a 5% drop within a span of 2 hours, for instance.

You can incorporate such a trigger on Cryptohopper like this:

Please note that we derived this number by assessing the prevailing market conditions of April 2024 at the time of writing this article.

Therefore, you may need to adjust these numbers based on the market's volatility.

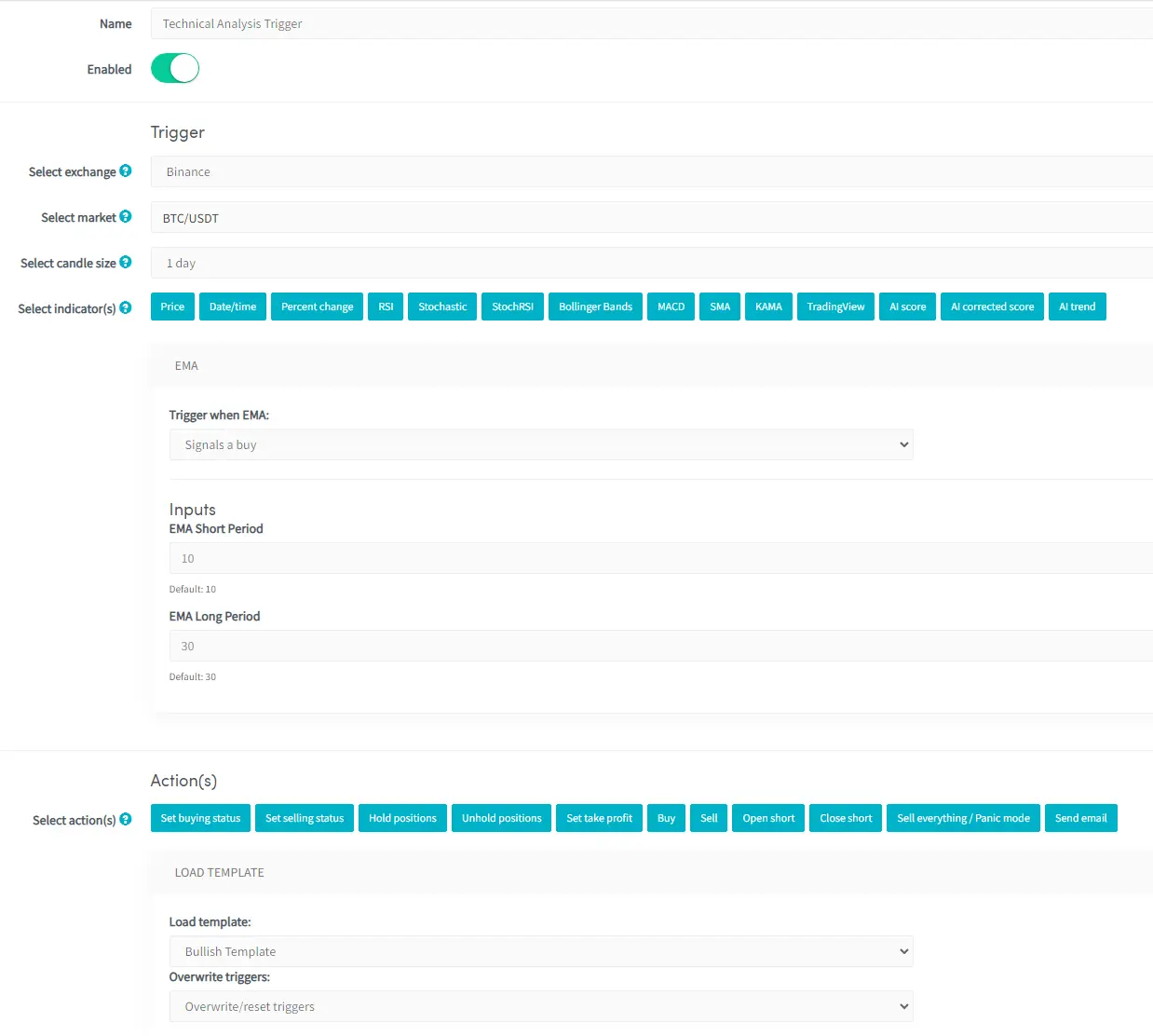

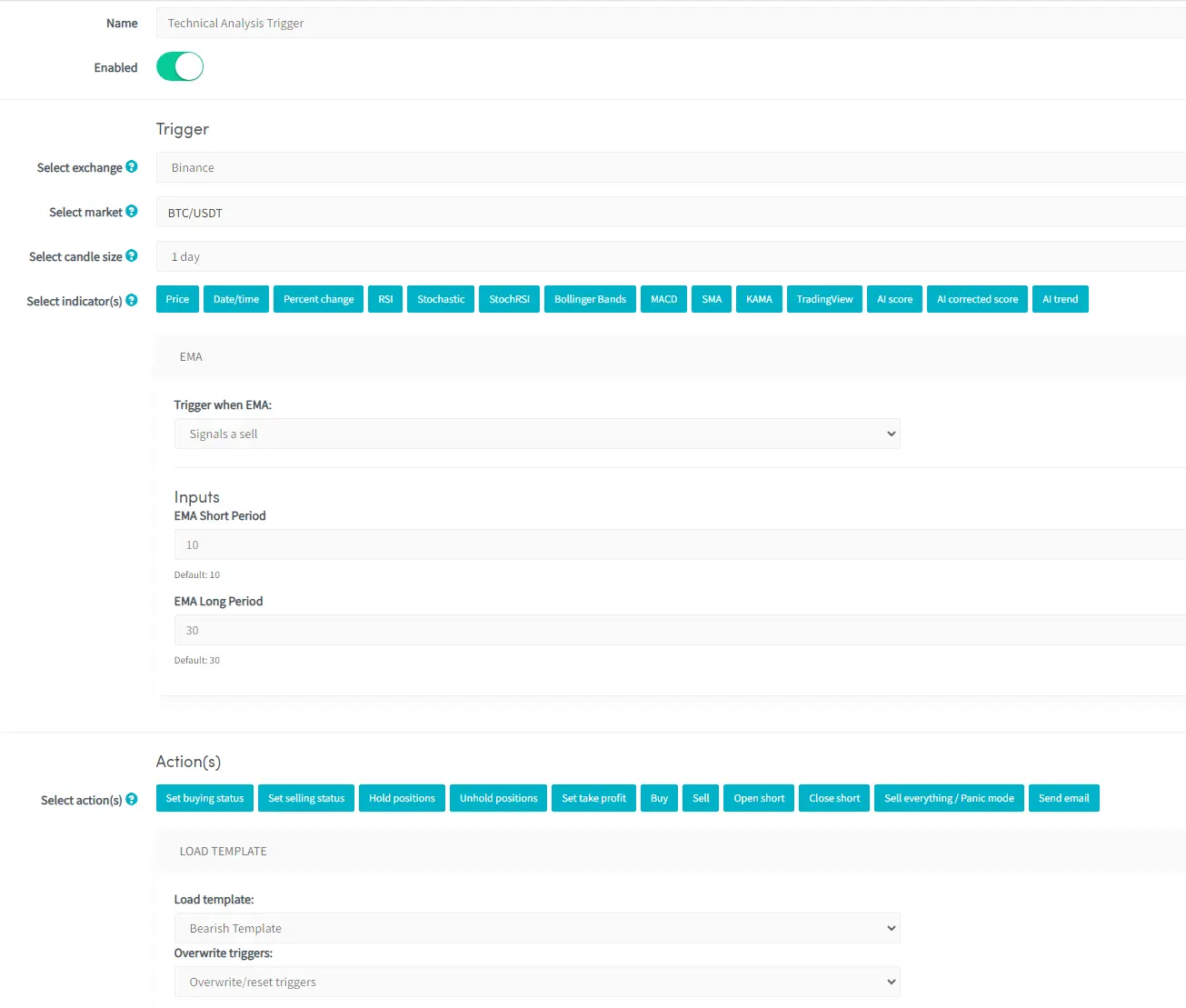

Technical Analysis Trigger

Another trigger that you can create is based on Technical Analysis. You can utilize trend-following indicators on the daily chart to ascertain the overall trend of the crypto market.

One example that often proves effective is the crossover of the 10 and 30 Exponential Moving Average (EMA) on the daily chart. When the 10 EMA crosses above the 30 EMA, we will implement the bull market template; conversely, when the 10 EMA crosses below the 30 EMA, we will switch to the bear market template.

We can incorporate the bull market trigger on Cryptohopper like this:

Similarly, we can include the bear market trigger on Cryptohopper like this:

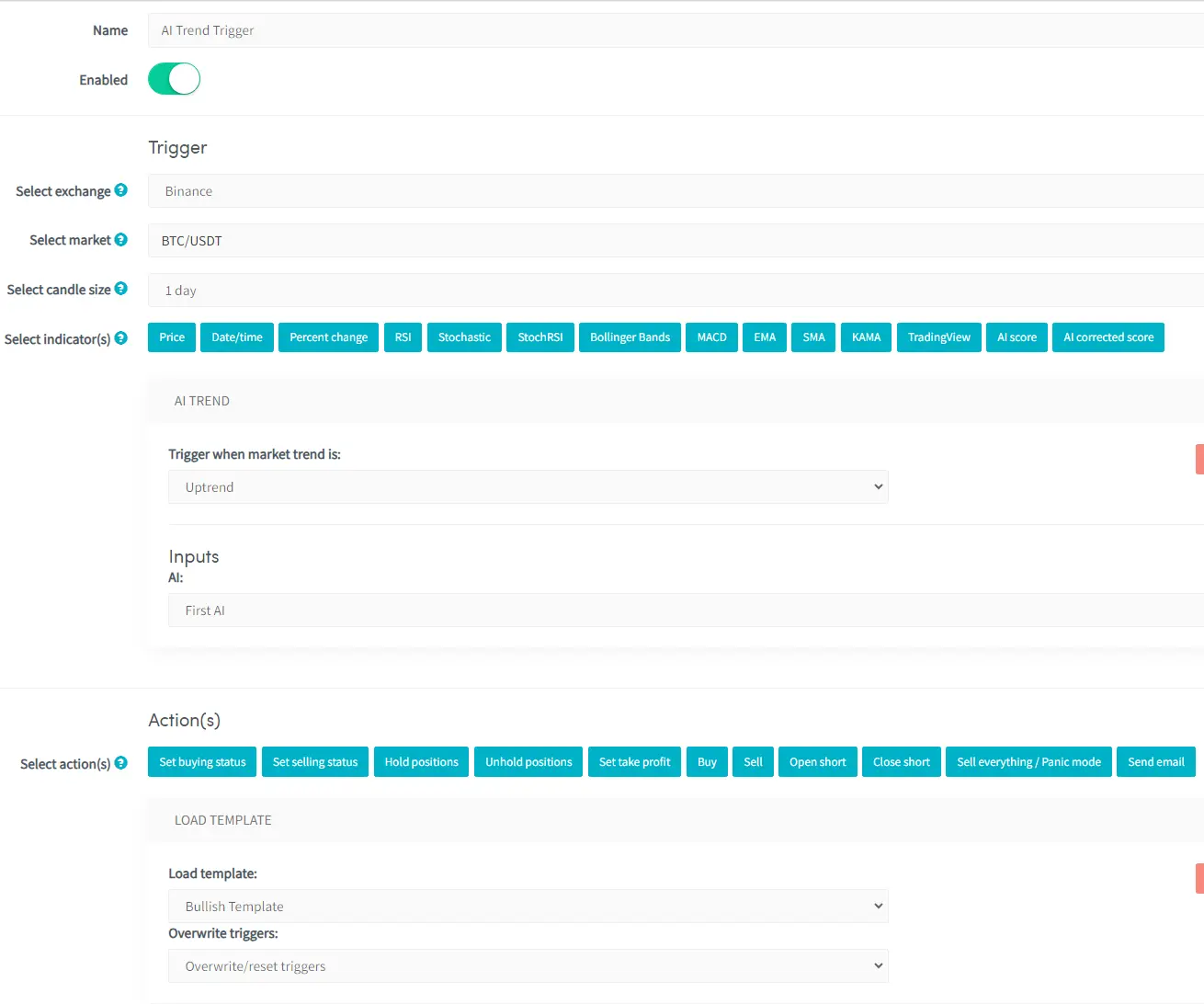

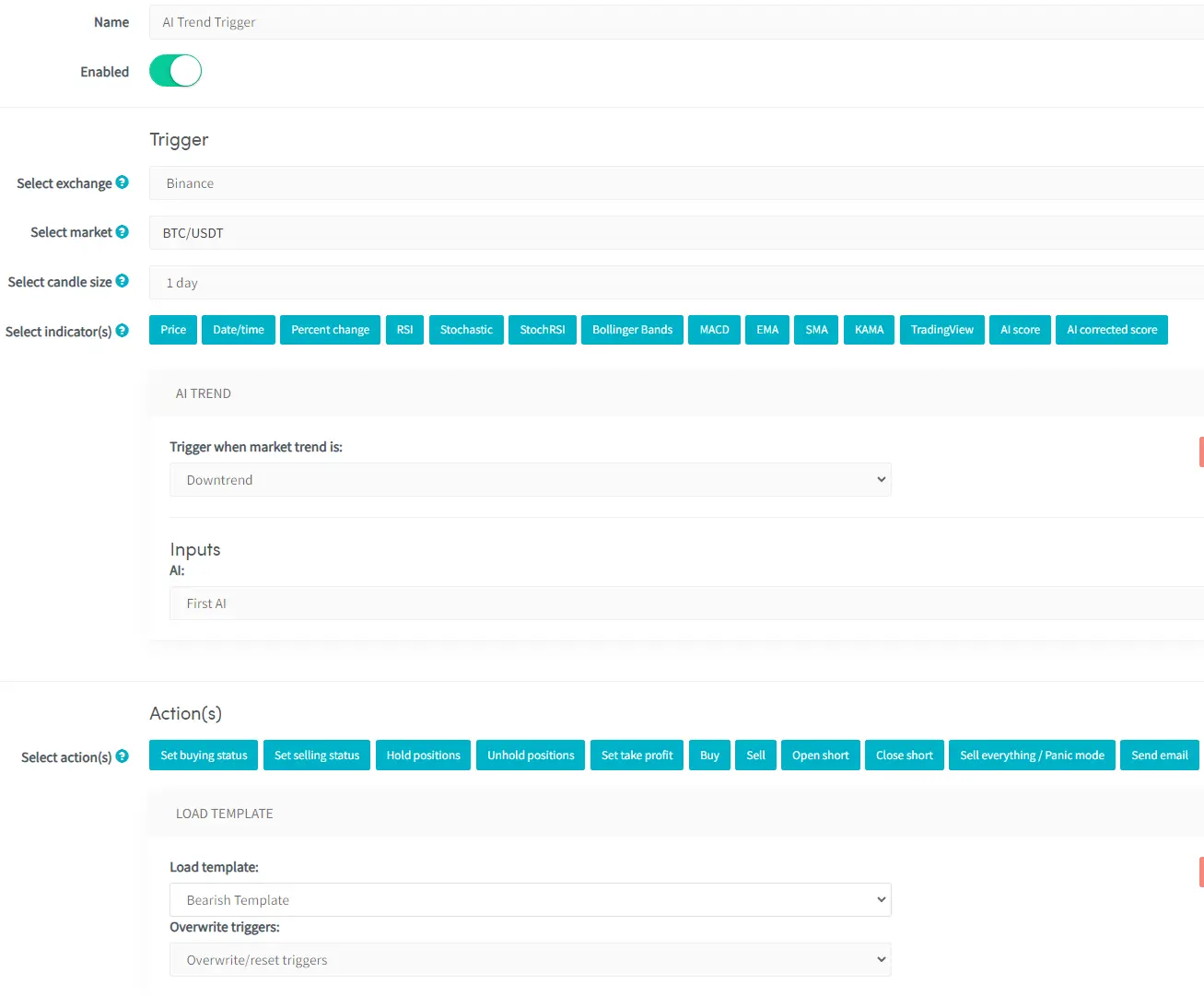

AI Trend

If you have a Hero Hopper, you can also utilize the Algorithm Intelligence (AI) to determine whether you are in a bull market or bear market. In such a scenario, it's generally preferable to set larger targets for the Trend when creating them in the AI panel. For instance, you could set it to something like a 10%-15% move in 3 days.

You can integrate the bull market AI trend on Cryptohopper like this:

Similarly, we can include the bear market AI trigger on Cryptohopper like this:

Once again, please bear in mind that we arrived at these numbers by considering the current market conditions of April 2024 at the time of writing this article.

Bottom Line

So, if you're trading cryptocurrencies, using triggers on platforms like Cryptohopper can be very beneficial. When the market is on the rise (bull market) or heading down (bear market), it's essential to adjust your bot accordingly.

Triggers help you do just that by automating actions based on what's happening in the market. Whether it's protecting yourself from sudden crashes, using technical analysis to identify the current market conditions, or following AI trends, setting up triggers helps you trade with the trend.