Mastering Cryptocurrency Momentum Reversal Trading

Hey Hoppers! Are you ready to dive into the exciting world of cryptocurrency momentum reversal trading? If you're someone who loves to catch trends as they shift direction and capitalize on sudden price reversals, then you're in for a thrilling ride. Get ready to learn all about the art of spotting momentum reversals and riding the wave to profit.

So, what exactly is cryptocurrency momentum reversal trading? Well, it's a strategy that focuses on identifying shifts in market sentiment and capitalizing on the momentum as prices reverse direction. Instead of following the crowd, momentum reversal traders aim to enter positions when the prevailing trend is losing steam and a new trend is about to emerge. It's a strategy that requires patience, discipline, and a keen eye for spotting potential turning points in the market.

Before we delve into the intricacies of momentum reversal trading, let's talk about why it's such an exciting strategy. Unlike other trading styles that require you to follow established trends, momentum reversal trading allows you to be ahead of the curve and catch trends as they're just beginning to form. It's like being able to predict the future and position yourself for maximum profit.

Now, let's talk strategy. One of the key principles of momentum reversal trading is identifying signs of market exhaustion. This could be indicated by a variety of factors, such as divergences in technical indicators, overbought or oversold conditions, or key support and resistance levels being breached. The goal is to enter positions when momentum is shifting in favor of a new trend and exit before the old trend fully reverses.

Timing is crucial in momentum reversal trading. Since you'll be looking to catch trends as they're just beginning to form, you'll need to be quick on your feet and ready to act decisively. Tools like RSI, Williams %R, Stochastics, Momentum and MACD can be incredibly useful in identifying potential reversal points.

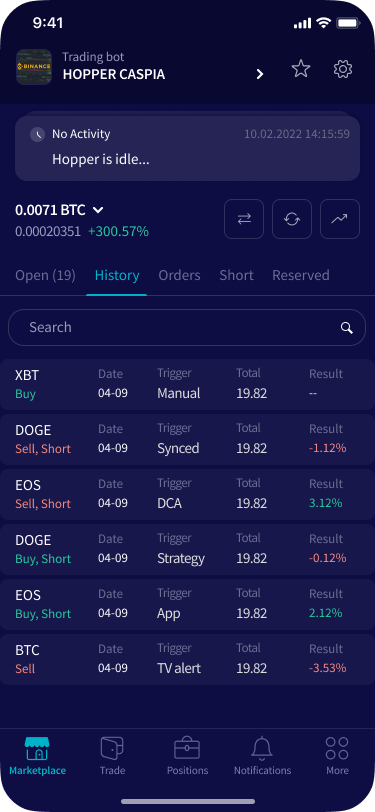

Let us consider an example of a momentum-reversal strategy applicable for trading on Cryptohopper. Additionally, to keep it simple, we will concentrate on a single cryptocurrency, namely Arbitrum (ARB).

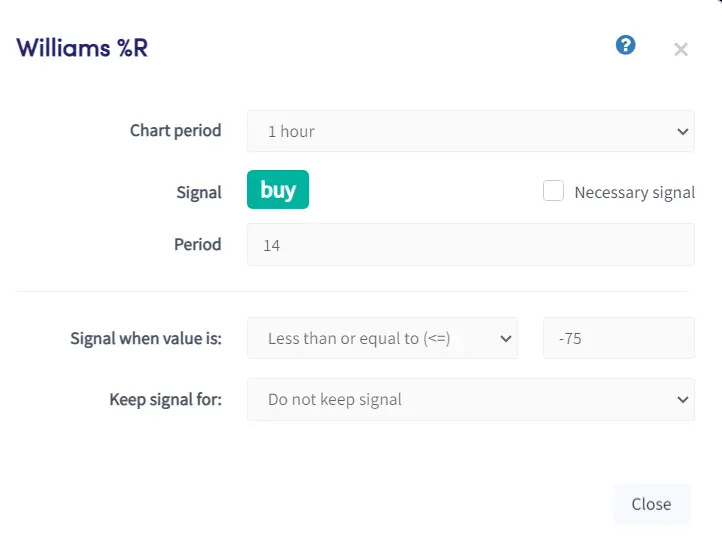

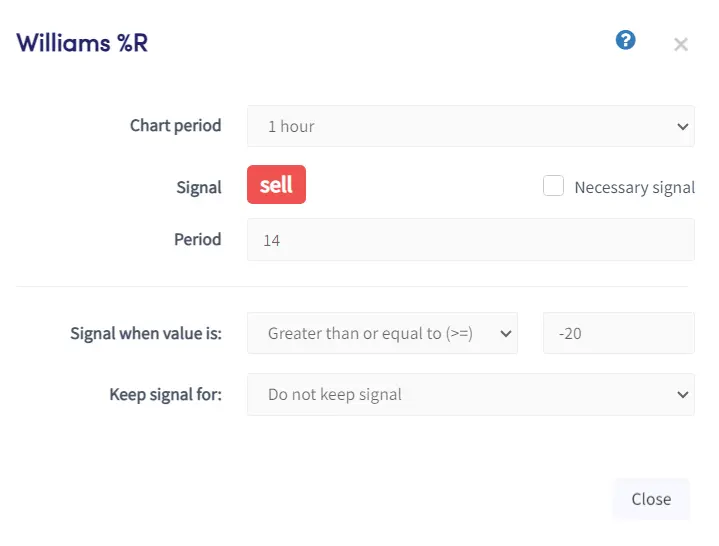

In this strategy, we employ a momentum oscillator known as Williams %R. We adhere to the classical approach for utilizing Williams %R, which means buying when it is oversold and selling when it is overbought.

When the Williams %R indicator indicates oversold conditions, it signifies a recent surge in selling pressure, resulting in a significant decline in price. Consequently, this presents a great moment to initiate a long position.

Conversely, when the Williams %R indicates overbought conditions, it suggests a recent surge in buying pressure, leading to a considerable increase in price. Hence, it is advisable to consider closing your long position.

Thus, the visualization on the chart would appear as follows:

The indicator itself appears as a line that oscillates between the values of 0 on the upside and -100 on the downside. Here, we've made slight adjustments to the default settings. In this configuration, the indicator will generate a buy signal when its value falls below -75 and a sell signal when it rises above -20.

Please keep in mind that Williams %R on Cryptohopper is a sticking indicator, meaning that it will continue to send the buy or sell signal for as long as the condition is met.

On the chart, the initial buy signals are denoted by blue arrows, while the initial sell signals are denoted by purple arrows.

This configuration on Cryptohopper will be displayed as follows:

You might have noticed that we adjusted the Chart period to 1 hour. We made this choice because momentum-reversal indicators tend to perform better on shorter timeframes, like 1-hour or below. So, using the 1-hour period is the optimal decision in this case.

Just a reminder, we need to apply the strategy twice: once for the buy signals and once for the sell signals.

If you applied this strategy to trade ARB/USDT from April 2023 to March 2024, you would have experienced an impressive 72.16% increase. We assume you invested all your assets into each trade and there's a 0.1% fee per trade. This outperforms the 8% return from simply buying and holding over the same period.

Additionally, the maximum drawdown is lower at 50% compared to the 70% drawdown of the buy and hold strategy. It's crucial to bear in mind that this results are based on historical data and do not guarantee future success. Additionally, our testing was limited to ARB/USDT, so results may vary with other cryptocurrencies.

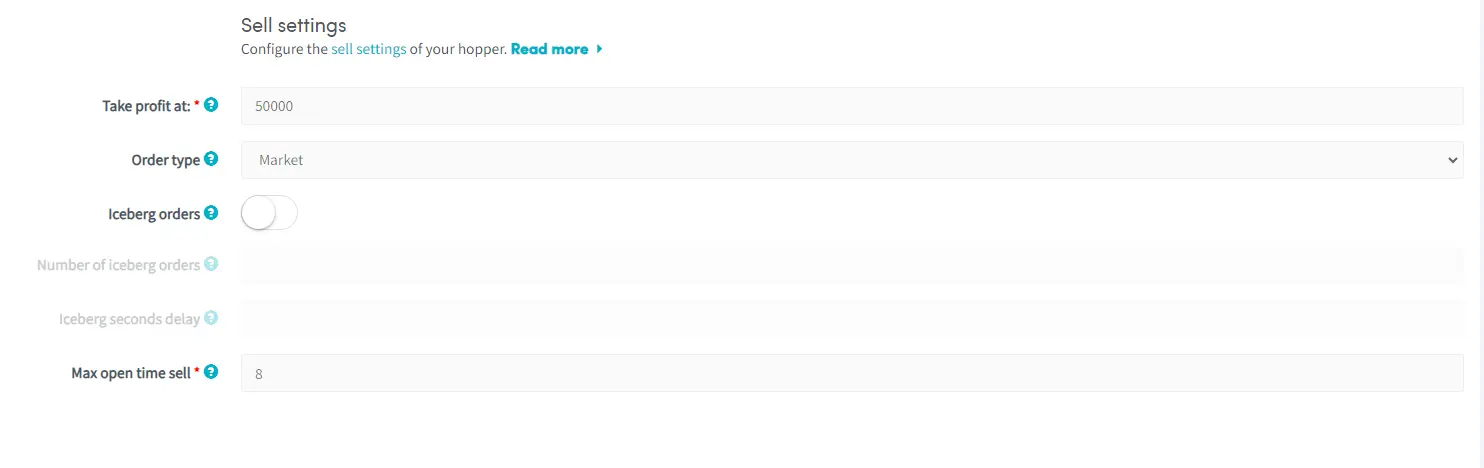

When it comes to trading, it's important to consider your bot settings, such as take-profit and stop-loss. For momentum-reversal indicators that generate persistent signals, it's often advisable to forgo these settings. This is because these indicators will keep sending buy signals as long as the buy condition is met.

Therefore, setting a stop-loss might not be effective, as the indicator will promptly generate another buy signal, rendering the stop-loss redundant. Hence, it's generally better to allow your indicators to decide when to initiate or close a trade.

On Cryptohopper, setting a take-profit level is required, but you could set it high, such as 5000, to ensure it's never triggered.

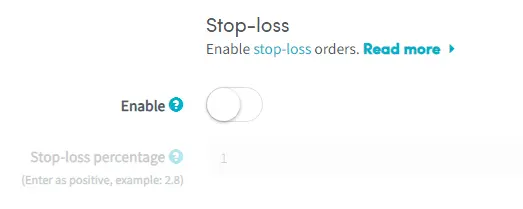

For the stop loss, you can simply leave it disabled.

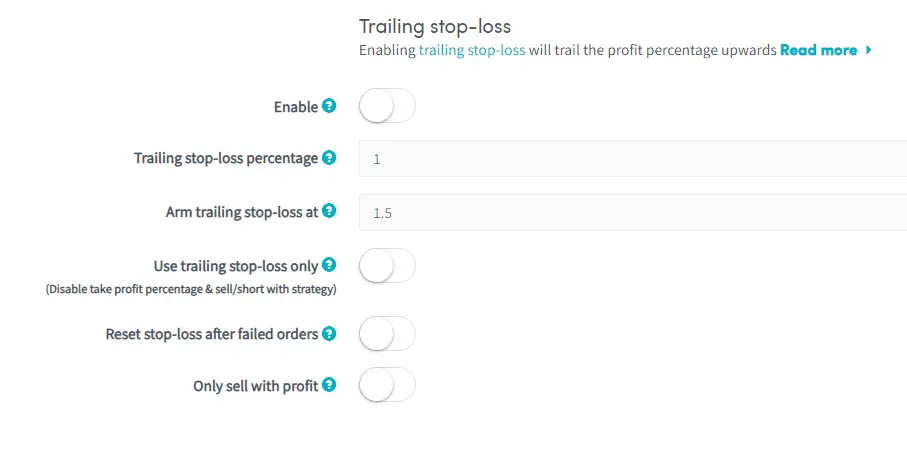

The same applies to the trailing stop loss: just leave it disabled.

Bottom Line

Cryptocurrency momentum reversal trading presents a great opportunity for traders to capitalize on shifting market sentiments and emerging trends.

By employing strategies like identifying signs of market exhaustion and utilizing momentum oscillators such as Williams %R, traders can position themselves ahead of the curve and maximize their profits. While historical data may provide insights into potential returns, it's crucial to remember that past performance do not guarantee future results.

Additionally, when implementing momentum-reversal strategies on platforms like Cryptohopper, adjusting bot settings such as take-profit and stop-loss becomes imperative to align with the persistent signals generated by the indicators.

Ultimately, mastering momentum reversal trading requires discipline, patience, and a continuous refinement of one's approach in response to evolving market conditions.