Automatic Trading

Explore the advantages of automated trading and its various types in this article. Learn how to begin your automated trading journey, with options ranging from easy to advanced. We'll cover semi-automatic, copy, and fully automatic trading methods.

Semi-Automatic Trading#

Semi-automatic trading can be useful for those who aren't ready to dive deep in the world of algorithms and algorithmic trading, as well as those who like to keep the buying decisions to themselves.

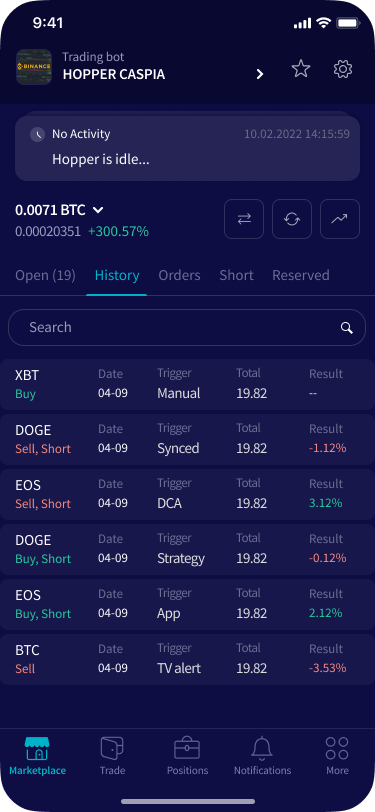

With semi-automatic trading, you are the one who opens up trades, but you use the bot to sell them automatically. This way, you can do your own analysis on the price, but utilize our unique features to sell automatically.

There are several tools that are useful for semi-automatic traders, which we discuss below. We divide these tools in 2 groups: buying & selling. Some of these tools help you to buy for better prices, while others help to sell automatically and with even better profits.

Buying#

Tools that are helpful when buying are the Trailing stop-buy, DCA, Short, and Trailing stop-short. If you don’t know these terms click the word to learn more.

Selling#

You have only made a profit when you’ve sold your investments for a stable currency like the dollar or the euro. Tools like Take-Profit, Stop-Loss, and Trailing Stop-Loss are ideal for helping you sell.

Copy Trading#

Copy trading involves mimicking the trades of experts on our platform. Our platform offers several options for copying traders, such as using our Copy-bot, signalers, templates, and strategies.