FAQ by CryptoTrader.Tax Crypto Tax in 2023

Depending on what country you live in, income received from your cryptocurrency investing and trading activity is subject to taxes. In this FAQ, we specifically address tax implications for the U.S., but similar concepts apply worldwide in 2023.

How to report cryptocurrency taxes

For more information, refer to this Cryptocurrency Tax Guide

How is crypto taxed

Cryptocurrencies themselves are not taxed. In other words, there is no tax for owning or holding cryptocurrencies like bitcoin. However, the income generated from investing activities is subject to taxes just like any other form of income.

Cryptocurrency is treated as property by the IRS. Similar to other forms of property like stocks, you incur capital gains and capital losses when you sell, trade, or otherwise dispose of your cryptocurrency.

For example, if you purchased 0.1 BTC for $1,000 in June of 2019 and then sold it two months later for $3,000, you would have a $2,000 capital gain. You report this gain on your tax return, and depending on what tax bracket you fall under, you pay a certain percentage of tax on the gain. Rates fluctuate based on your tax bracket as well as depending on whether it was a short term vs. a long term gain.

Do I have to report each trade on my taxes

Whenever you dispose of a cryptocurrency (trade for another crypto or sell it) you incur a capital gain or a capital loss. Each capital gain and capital loss needs to be reported on IRS Form 8949.

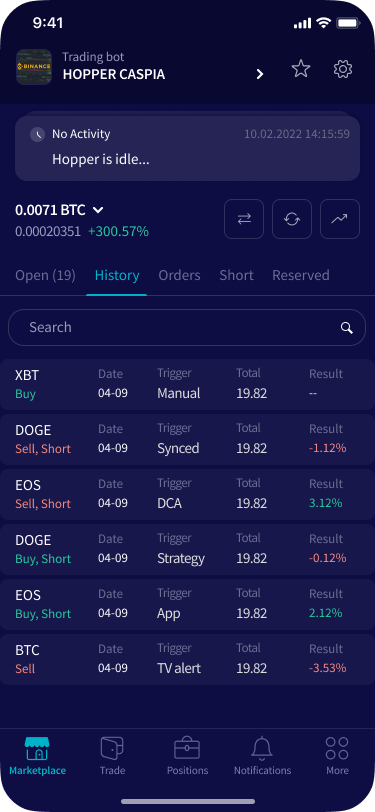

For high volume traders using automated trading software, reporting all trades can be a tedious process. Cryptohopper has partnered up with CryptoTrader.Tax, a cryptocurrency tax software platform to make this a seamless process for traders.

If I just buy and hold, do I owe taxes

No. Simply buying and holding your crypto does not realize a taxable event. You only realize gains and losses when you dispose of your crypto (sell, trade, or use it to purchase goods or services). As defined by the IRS, you incur a taxable event when any of the following occur:

- Trading cryptocurrency to fiat currency

- Trading cryptocurrency for another cryptocurrency

- Using cryptocurrency to purchase goods and services

- Earning cryptocurrency as income

How do I calculate my gains and losses

To calculate your capital gains or losses from your cryptocurrency trades, simply subtract your cost basis in the asset from the fair market value. Cost basis is simply the amount in US Dollars that it cost you to acquire that coin. Fair market value is simply the amount in US Dollars that the coin is worth at the time of trading it or selling it. The equation below shows how this works.

Fair Market Value - Cost Basis = Capital Gain/Loss

If I lost money and have capital losses, can those be written off to reduce my tax liability

Yes! Just like if you were to lose money when trading stocks, capital losses from your cryptocurrency transactions deduct from your capital gains and income. In effect, they reduce your taxable income and put money back in your pocket.

If I earn cryptocurrency from mining, staking, or interest reward, do I owe taxes

In short, yes.

Earning cryptocurrency from mining, staking, or other related transactions is a form of income that needs to be reported on your taxes. The amount of income you recognize is equal to the fair market value of the received cryptocurrency in your home fiat currency at the time of receiving the reward or payout.

How can cryptocurrency tax software help

Cryptocurrency tax software like CryptoTrader.Tax can automate the tax reporting process for cryptocurrency investors. Similar to Cryptohopper, CryptoTrader.Tax integrates with leading cryptocurrency exchanges and platforms. Users can import all of the historical trade data from their crypto exchanges with the click of a button. Based on this historical data, these platforms will auto-generate all of your necessary tax reports.