FAQ by CoinTracking Crypto tax in the USA in 2023

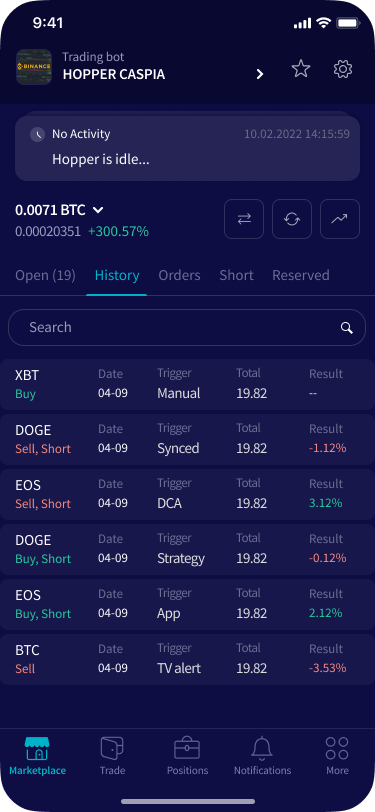

Cryptohopper is here to help you tackle this crypto tax season in 2023 as the deadline is approaching in the US.

How to report crypto taxes in the USA

You have until October 15 (extended deadline) to file your crypto taxes, but do you know all the details?

We’ve partnered with CoinTracking, the leading crypto tax software in the market, to help answer the most pressing crypto tax questions!

CoinTracking is also offering a 10% discount to Cryptohopper users this tax season! Let’s jump into the top crypto tax questions and answers!

How is crypto trading taxed in the US

Trading cryptocurrencies for FIAT (e.g., USD) or other cryptocurrencies are taxable events in the US, leading to capital gain taxes. The only exception is purchasing crypto with Fiat.

According to the IRS, every time you buy and sell a cryptocurrency, you’d have to determine the gain/loss on that transaction and report it in your tax return.

Discover everything about crypto taxes in the US from this extensive guide.

How much taxes do you pay on crypto

Your crypto tax rate will depend on the holding period of your crypto transactions and other factors, ranging from 0% to 37%.

If you hold your crypto assets for over 12 months before selling, you’d be taxed at a long-term rate, ranging from 0% to 20%, depending on some other personal factors.

However, if you held your crypto for 12 months or less, you’d be taxed at a short-term tax rate, ranging from 10% to 37%, depending on other personal factors.

You can also be taxed at an income level based on your total income tax bracket if you have other crypto income (e.g., interest, staking rewards).

Do you pay taxes when spending crypto for products

Spending any cryptocurrency to buy any service or product is a taxable event in the US, subject to capital gains taxes.

You’ll have to determine the gain/loss on each transaction on top of the expense of buying the product. Check this example on how crypto purchases are taxed.

How are airdrops and hard forks taxed

Airdrops and hard forks are taxed at the income level in the US, despite being different crypto transactions.

Each time you receive crypto from an airdrop or a hard fork, you need to determine its Fair Market Value (in USD) upon receipt and report it in your income tax return.

All the crypto income from airdrops and hard forks will be added to your total income for the year and taxed according to your income tax bracket. Discover more about airdrop taxes and hard fork taxation.

How is staking and crypto interest taxed

Staking rewards and crypto interest are taxed the same way in the US, both subject to income taxes.

When you receive a batch of crypto interest or staking rewards, you’d need to determine their Fair Market Value (in USD) at the time you received them. These amounts will be added to your total income for the tax year.

Discover more about staking taxes and crypto interest taxation.

How are NFTs taxed

Trading Non-Fungible Tokens (NFTs) in the US will lead to the same tax consequences as trading any cryptocurrencies.

If you buy and sell NFTs, you’d need to determine the gain/loss on each NFT trade, and you’d be taxed at a capital gains level (if you have gains), with a tax rate ranging from 10% to 37%, depending on your holding period and other factors.

If you’re an NFT creator, your sales proceeds (minus your cost basis) will be taxed at an ordinary income level, with a tax rate dependent on your total income for the year. Discover more about NFT taxes.

How to report crypto taxes in the US

If you have any gains/losses from crypto trading, NFT trading, or buying products with crypto, you’d be taxed at a capital gains level. To report those gains/losses, you need to complete some crypto tax forms, including Schedule D and Form 8949 for your Form 1040.

Any income from airdrops, hard forks, interest products, staking, or crypto salaries, is taxed at an income level. Different income items may need to be reported in different parts of your tax return. Consult your crypto tax advisor for proper reporting.

Discover all the details on how to report US crypto taxes.

The easiest way to report your crypto: CoinTracking

CoinTracking is the most complete crypto tax solution in the market for this tax season. With the premier crypto tax software, you can:

Import your crypto trades from hundreds of exchanges/blockchains Determine crypto capital gains/losses and income Generate compliant crypto tax forms.

Register today with a 10% discount!

How to lower your crypto taxes?

There are a few legal ways to reduce your crypto taxes, including:

- Sell your crypto after holding it for over 12 months, benefiting from a long-term tax rate.

- Deduct losses against gains by using crypto tax loss harvesting.

- Take crypto loans instead of selling your crypto for your expense needs.

- Use retirement plans(e.g., IRAs) to invest in crypto.

- Move to an income-tax-free or crypto-friendly state.

- Move to a crypto-friendly country.

Discover more ways to reduce your crypto taxes.

Disclaimer: All the information provided above is for informational purposes only and should not be considered as professional investment, legal, or tax advice. You should conduct your own research or consult with a professional financial advisor when investing.