FAQ by CoinTracking Crypto Tax in Germany 2023

There are often uncertainties regarding the taxation of cryptocurrencies in Germany. In collaboration with CoinTracking, the leading crypto tax software in the market, we address the most important questions about crypto tax in Germany!

How to report cryptocurrency taxes in Germany

Cryptohopper customers benefit particularly from the partnership with CoinTracking and receive an exclusive 10% discount.

How are cryptocurrencies taxed in Germany

In Germany, cryptocurrencies are considered assets. As a private investor, gains from the sale of cryptocurrencies are subject to personal income tax.

What happens if I hold my cryptocurrencies for more than a year

There is a one-year holding period. If cryptocurrencies are held for more than a year, the gains in Germany are tax-free.

How are income from staking cryptocurrencies taxed in Germany

If the threshold of 256 euros is exceeded, taxes must be paid on staking. The rewards received are considered other income and are taxed at the personal income tax rate upon receipt. Rewards are treated like purchased cryptocurrencies and are subject to the one-year holding period.

How are Airdrops treated for tax purposes in Germany

If Airdrops are credited without any consideration from the recipient, they are considered tax-free upon receipt. However, this rule changes as soon as consideration is provided to receive the Airdrop, and an "exchange of services" takes place.

How are NFTs taxed in Germany

If NFTs are acquired for consideration and sold within the one-year holding period, they are considered private sales transactions. If the threshold of 600 euros per year is exceeded, the resulting profit must be taxed at the personal income tax rate.

How are crypto mining income taxed in Germany

If the threshold of 256 euros per year is exceeded, the mining income received at the time of receipt is subject to personal income tax. A subsequent sale within a year results in additional taxation. Different regulations apply to commercial mining.

How can I accurately document my crypto transactions

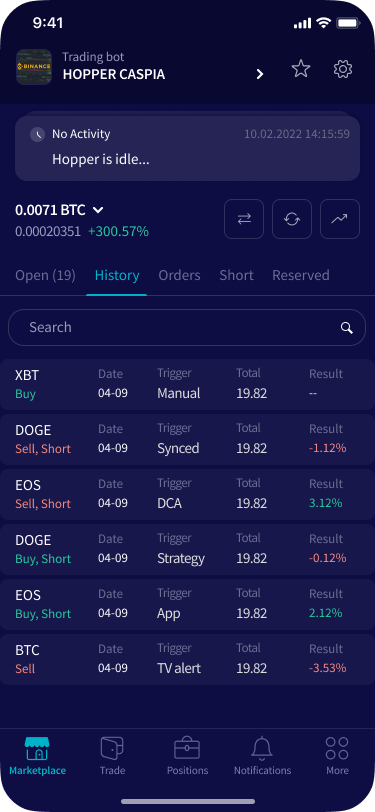

Accurate documentation of crypto transactions is crucial for tax reporting. Tools like CoinTracking can help track and document all transactions.

Can I deduct losses from crypto trading from my taxes

If cryptocurrencies are sold at a loss within a year, there is the possibility to offset these losses against gains from cryptocurrencies. Losses can be carried back to the previous year or carried forward to the next year (loss carryforward and carryback). Losses incurred after one year cannot be claimed for tax purposes.

What are the penalties for not reporting crypto income in Germany

Gains earned must be properly taxed. Depending on the amount of evaded income, tax evasion can result in both fines and imprisonment. In addition to repaying the evaded taxes, interest and late payment penalties must also be paid.

How can I benefit from the partnership between Cryptohopper and CoinTracking

The partnership offers Cryptohopper customers an exclusive 10% discount for using CoinTracking.

Conclusion

Trading and investing in cryptocurrencies in Germany come with tax obligations. In cooperation with CoinTracking, Cryptohopper provides all the tools to efficiently manage crypto transactions. With the exclusive 10% discount for Cryptohopper customers, CoinTracking is the best method for portfolio tracking and tax report generation.

Disclaimer: All information provided above is for informational purposes only and should not be considered as professional investment, legal, or tax advice. You should conduct your own research or consult a professional tax advisor.