What are the settings in the Market Making bot

This tutorial explains the settings you need to fill in for the Market Making bot.

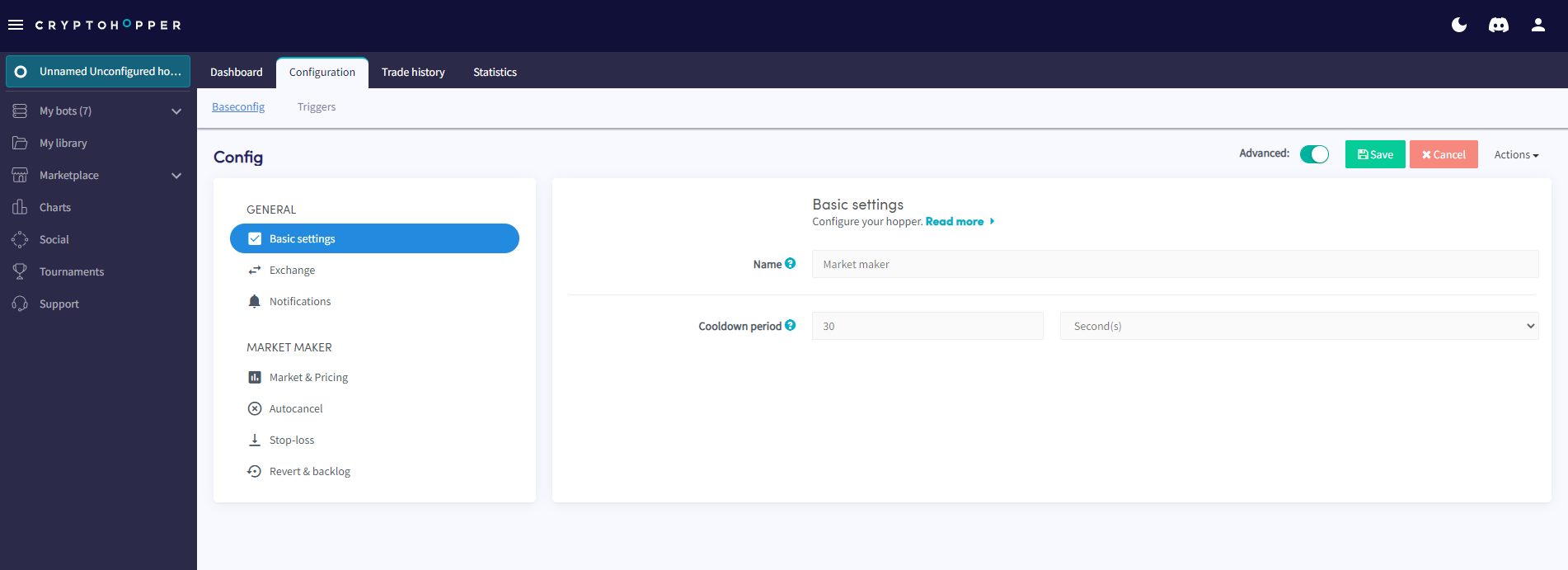

Basic settings

Name

Give your bot a name.

Cooldown period

Decide if you want to use a cooldown period and how long the cooldown period should take. The Market Maker bot will wait for this period before placing a new order.

Exchange

Paper trading

When you want to trade with simulated funds switch the toggle.

Exchange

If you want to trade real funds select your Exchange.

API Key

Fill in your API Key.

Notification

Notification on trade

Switch the toggle if you want to receive a notification when your bot made a trade.

Notification on trade error

Switch the toggle if you want to receive a notification when there’s a trade error.

Notify on canceled order

Switch the toggle if you want to receive a notification when an order is canceled.

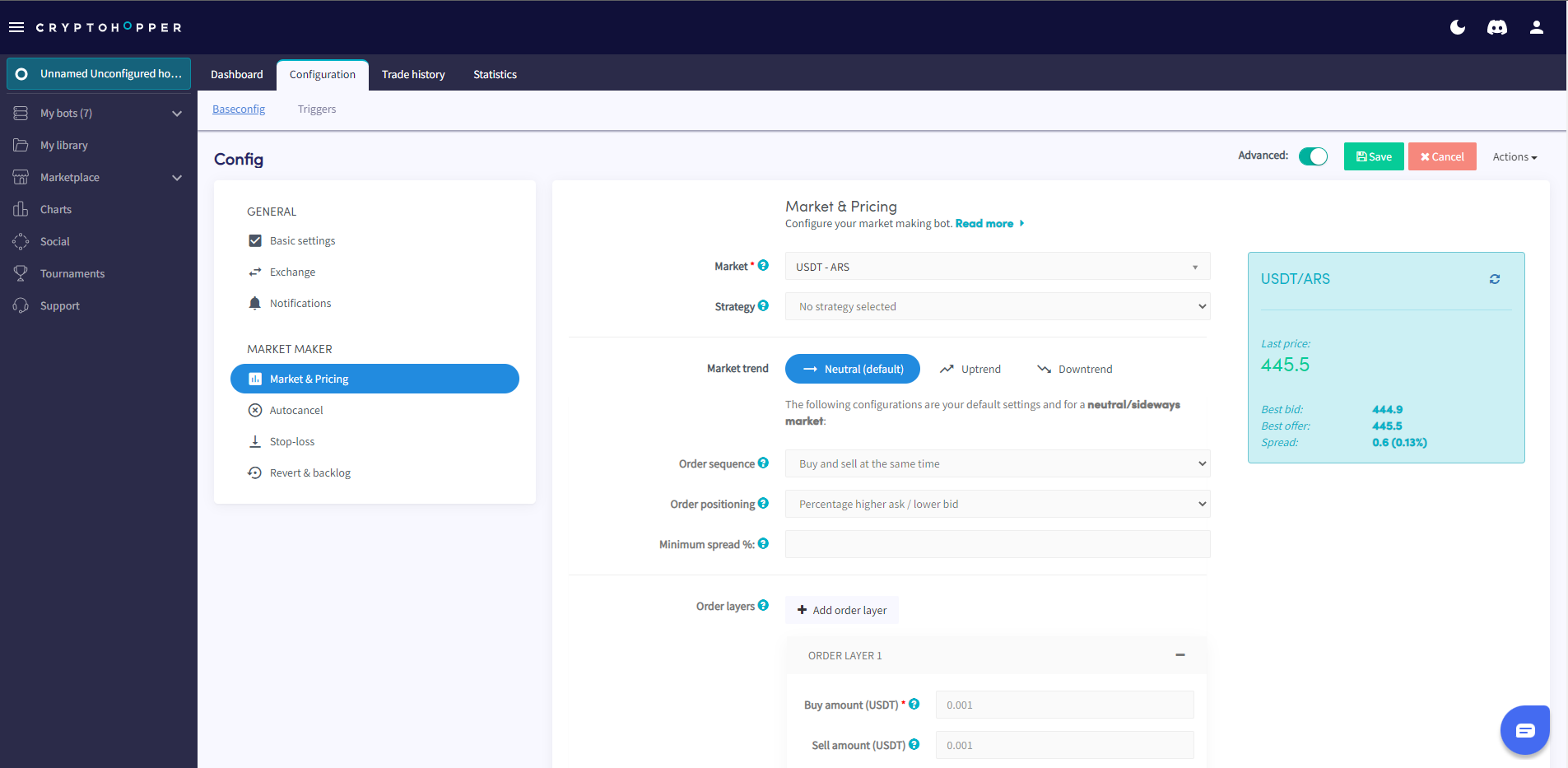

Market & Pricing

Market

Select the market you want to “make”. On the left side, you see the current spread. Select a market with a big enough spread to make a profit. Your profit should be at least double your trading fee. Check out the Charts section on the left menu and select the Markets tab to see which currencies have a spread you can profit from and sufficient trading volume.

Strategy

Select the strategy you want to use. You can make a strategy yourself or download one from the Marketplace.

Market Trend

Toggle between Neutral, Uptrend, or Downtrend to configure what your market-maker should do in different markets. The order sequence should be different in different market trends. Or you can decide to buy smaller positions in downtown-trending markets (or no positions at all).

Order Sequence

For a neutral market, it’s normal to buy & sell at the same time. In an up-trending market, it’s normal to buy first and sell later. The opposite is normal for a down-trending market.

Order Positioning

Select at which position in the order book your orders should be placed. As a Market Maker, you want to make orders quickly. So it's recommended to place your Market Maker as number one in the order book.

Minimum Spread

You’re trading for a profit so set this setting to twice your trading fee. Otherwise, you will make a loss.

Order Layers

Do you want orders at multiple positions in the order book? This is to create liquidity and a "healthy" order book. Set the buy amounts per layer, or stick with just one layer.

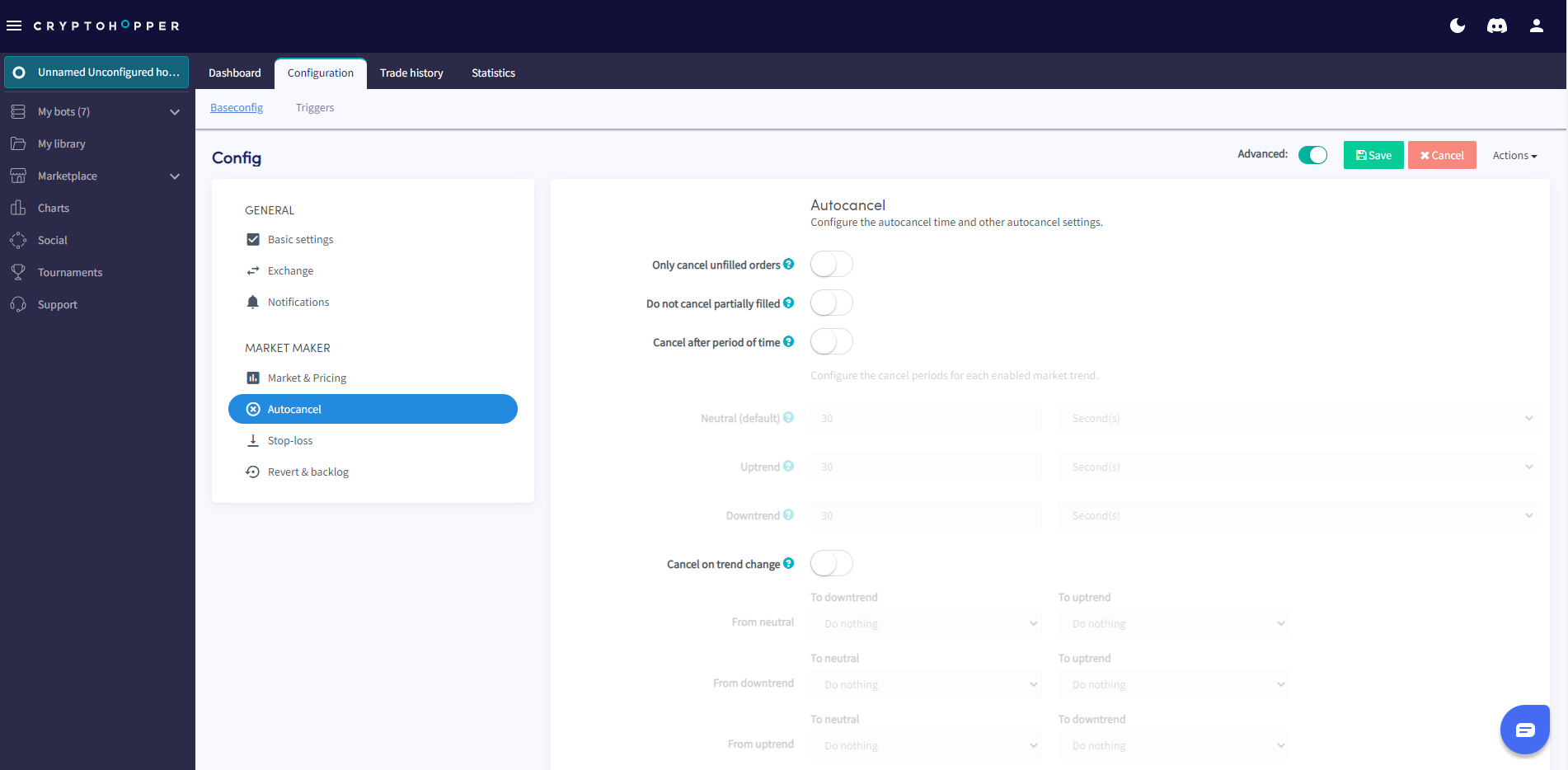

Autocancel

Only cancel unfilled orders

Switch the toggle if you want to use this setting. For example: if a buy is filled and a corresponding sell is not, then the sell will not be cancelled.

Do not cancel partially filled

When enabled, partially filled orders of market makers will not be cancelled.

Cancel your orders automatically

You don’t want your orders to stay open forever because it reserves a portion of your funds! There are a lot of possibilities to decide why/when your orders should be canceled automatically:

After a period of time

Don't want your orders to stay open longer than a given time? That's easy: simply configure the number of seconds/hours/days it can stay open. The minimum time is 30 seconds, and the maximum time is 99 days.

Cancel on trend change

You want to cancel your orders if the trend changes. For example, if you're in a neutral trend and the markets are heading downwards. Configure when your orders should be canceled to build in an extra layer of safety.

Cancel on percent change

Use this setting when you don't have a good market trend strategy or analyze the markets yourself and know where a support or resistance is.

Cancel on Depth

The markets change, and other traders may put their orders on top of yours. Cancel orders automatically when X amount of orders are "on top of yours".

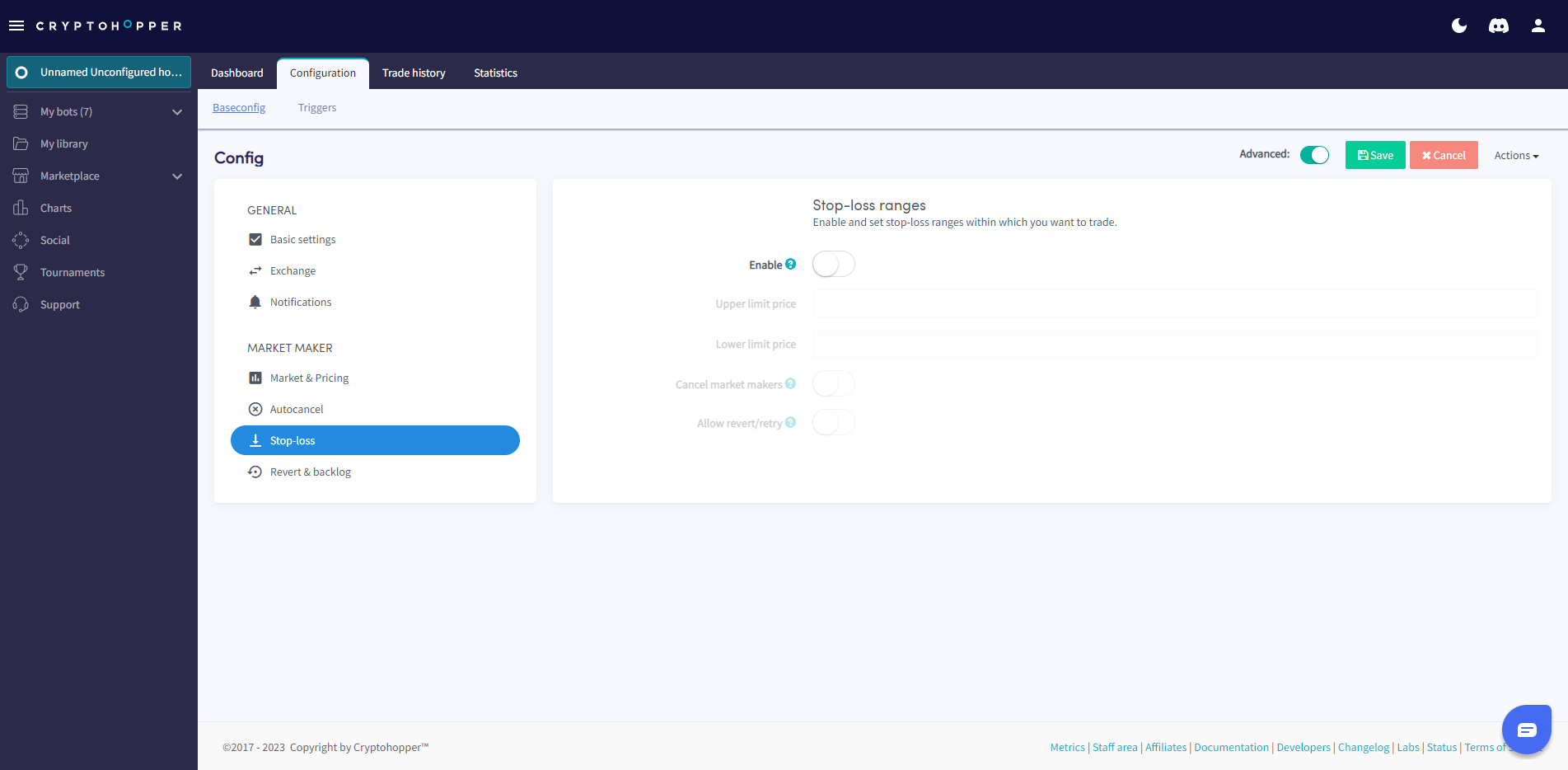

Stop-Loss

Enable

Switch the toggle if you want to use a Stop-Loss. The Stop-Loss is a crucial way of protecting your investments. You can use it with your market-maker as well, but it's a bit different. The Stop-Loss in your Market Maker determines in what price range your bot is allowed to trade.

Upper limit price

Fill in a specific price. Your bot will only trade within these ranges.

Lower limit price

Fill in a specific price. Your bot will only trade within these ranges.

Cancel market makers

Switch the toggle to cancel both (buy and sell) orders when your Stop-Loss is hit.

Allow revert/retry

Toggle the switch if you want your orders to be put back in the order book when the price is back in your price range, and your bot is allowed to trade again.

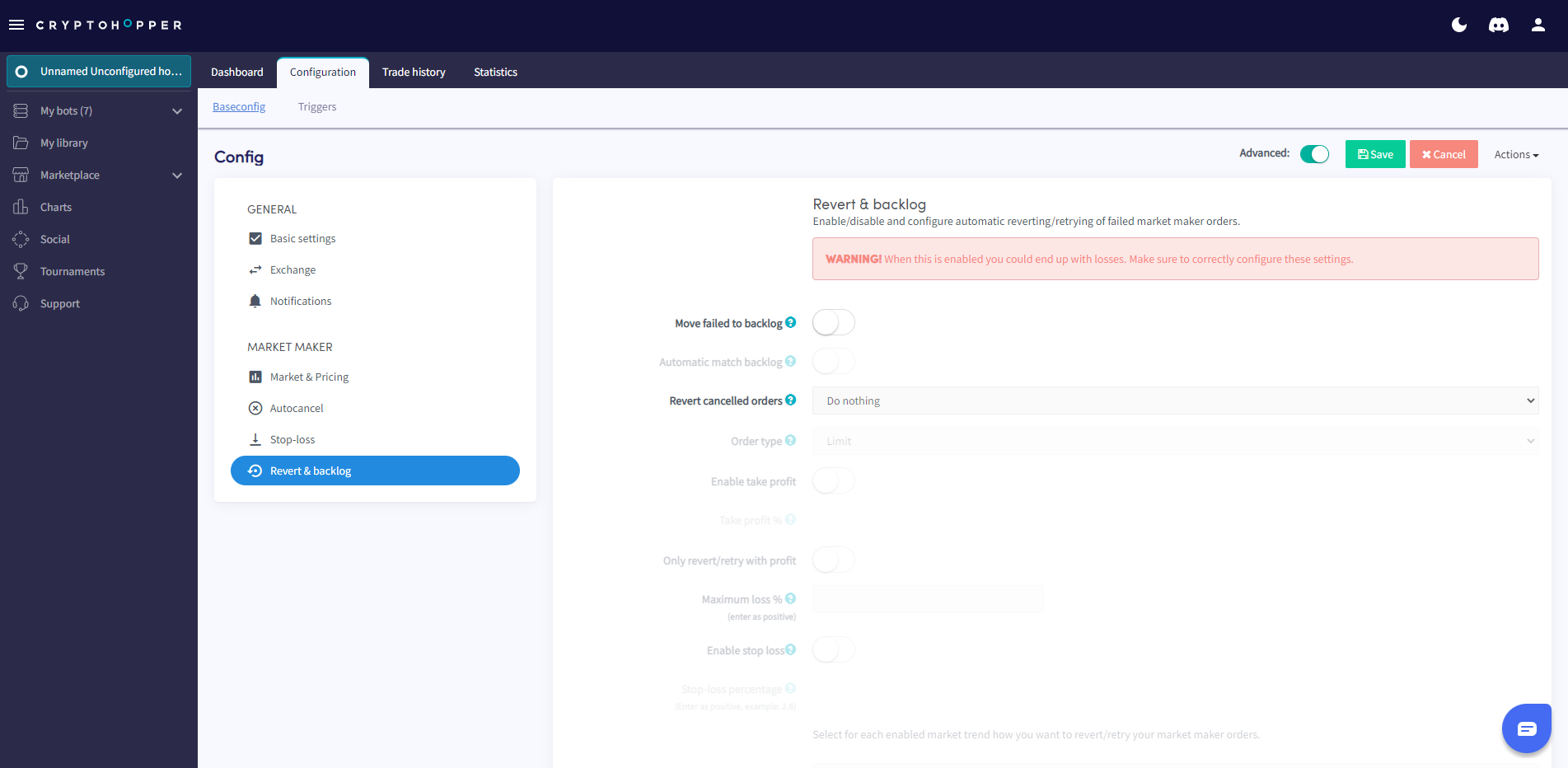

Revert & backlog

The Revert & Backlog is a way to "keep" failed and canceled orders in a backlog, waiting to be traded again.

Let's say your buy order succeeded, but your sell order failed. Move it to the backlog so your bot can try again. It also shows how you're performing and what your loss-making trades are. We recommend using this feature to improve your profitability and ensure you're not left with "bags".

Move failed to backlog

Switch the toggle if you want failed and canceled orders to be moved to the backlog.

Automatic match backlog

Switch the toggle if you want to automatically match the orders in the backlog. For example, if you have multiple sell orders for the same currency that don’t get filled, they will be merged into 1 backlog position.

Revert canceled orders

Switch the toggle so canceled and failed Market Making orders will be reverted.

Order type

Select the order type you want to use for reverting canceled orders.

Enable take profit

Switch the toggle if you want those “left-over” orders to make a profit.

Take profit%

Fill in the percentage profit you want to make with the “left-over” orders.

Only revert/retry with profit

Switch the toggle if you only want to revert/retry with a profit.

Maximum loss %

Fill in the %.

Enable Stop-Loss

Switch the toggle if you want the “left-over” orders to be sold when they go lower than the percentage configured.

Stop-Loss percentage

Fill in the percentage.

Neutral trend, Uptrend, and Downtrend

Select for each market how you want to revert/retry your market maker orders.